China Fund News reporter Jin Youzhi

After suddenly encountering US sanctions, Russia’s latest response came.

“The actions of the United States are unacceptable.”

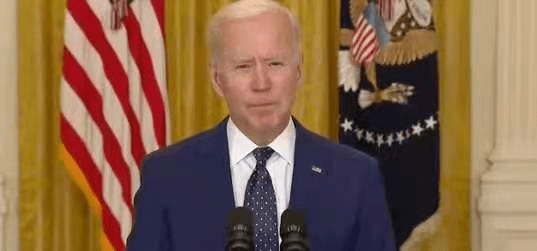

Biden also spoke after the announcement of the sanctions, warning that there may be more actions.

The sanctions increased risk aversion, and gold rose immediately. U.S. stocks also rose sharply under the support of strong economic data, with the Dow and S&P 500 reaching new highs.

Suddenly sanctioned, Russia responded!

The latest statement: unacceptable, will “resolutely fight back”

According to the World Wide Web, on April 15, local time, US President Biden signed an executive order, launching a series of sanctions against Russia’s “harmful foreign behavior.” The White House stated that the United States hopes to establish a “stable and predictable” relationship with Russia, but that Russia must pay the price for trying to harm American behavior.

The new round of US sanctions against Russia includes the Ministry of the Treasury’s prohibition of US financial institutions from participating in a series of Russian bonds and fund investments; actions against six Russian technology companies. The United States will also expel 10 diplomats from the Russian diplomatic mission in Washington.

In the early morning of the 16th Beijing time, Russia’s latest response came!

According to CCTV News, Russian Foreign Ministry spokesperson Zakharova issued a warning on the same day that Russia would “resolutely fight back” the “aggressive behavior” of the US.

Russian Foreign Ministry spokesperson Zakharova stated at a regular press conference that the responsibility for the deterioration of Russia-US relations lies solely with the United States. The actions of the US side did not indicate that it is willing to promote the normalization of Russia-US relations. Russia has repeatedly warned that hostile actions by the United States against Russia may trigger consequences including intensifying confrontation between the two sides. The United States should realize that it has to pay a price for the deterioration of bilateral relations. Russia will “resolutely fight back” the “aggressive behavior” of the United States.

Russian Foreign Ministry Spokesperson Zakharova: The United States is unwilling to accept this objective fact, that is, in this multi-polar world, the United States no longer enjoys hegemony, but also expects to impose sanctions and pressure to interfere in Russia’s internal affairs. Such hostile acts will be resolute Retaliation, (Russia)’s retaliation against sanctions will be inevitable, and the United States should realize that it must pay the price for the deterioration of Russia-US relations.

The spokesperson also announced that because the United States announced a series of sanctions against Russia, the Russian Foreign Ministry summoned the US ambassador to Russia.

Later that day, the official website of the Russian Ministry of Foreign Affairs summoned the US ambassador to Russia to make a relevant statement.

The statement stated that on the same day, Russian Deputy Foreign Minister Yabukov summoned Sullivan, the US ambassador to Moscow. The Russian side believes that the actions of the US side are unacceptable, which violates the US declared will to “establish a pragmatic relationship with Russia” and has caused a new serious blow to the bilateral relations between Russia and the United States.

The statement stated that the US ambassador to Russia was told that Russia will take a series of response measures to US sanctions as soon as possible. For a long time, in order to maintain Russia-US relations at an acceptable level, Russia has always shown an extremely responsible attitude. However, successive governments in Washington have scorned the constructive proposals of the Russian side and exacerbated the deterioration of the situation.

The two sides also exchanged views on other issues of bilateral relations.

Earlier in the day, Russian Foreign Ministry spokesperson Zakharova stated at a regular press conference that because the United States announced a series of sanctions against Russia, the Russian Foreign Ministry summoned the US ambassador to Russia.

Biden also speaks

Warning that there may be more actions

After the announcement of sanctions against Russia, Biden delivered a speech later the same day.

According to the Guardian, in his speech, Biden warned that if Russia continues to interfere with American democracy, the United States may take more actions.

Biden said, “President Putin and I are very clear that we can go further. But I chose not to do so.” But Biden said that he did not want to escalate the tension. He said, “We want a stable, Predictable relationship.”

According to CNN, with regard to the tension with Russia, Biden also emphasized that “now is the time to ease.”

Speaking at the White House, Biden said that he told Russian President Putin on a conference call earlier this week that he could have taken these steps further. Although Biden hopes to avoid escalation of tensions, he made it clear that he will take further actions without hesitation in the future.

Biden also mentioned that communication with Putin is crucial to the relationship between the two countries; the US and Russian teams are still discussing the possibility of holding a summit.

Strong economic data, U.S. stocks soared

The Dow broke 34,000 for the first time, and the S&P 500 also hit a new high

The economic data released by the United States on Thursday was too strong.

The first is that the number of initial jobless claims hit a record low in more than a year. According to data from the US Department of Labor, the number of people applying for unemployment benefits for the first time in the United States was 576,000 in the week of April 10, the lowest since the week of March 14 last year, which was far below the expected 700,000, and significantly lower than the previous value of 744,000. .

In addition, spurred by a $1,400 cash check, US retail data also exploded. In terms of retail sales data, US retail sales in March increased by 9.8% month-on-month, the highest level in 10 months, far higher than market expectations of 5.8%. Among them, the sales of the catering industry increased by 13.4%, and the sales of clothing retailers increased by 18.3%, both setting the highest growth rate since June last year.

With the support of strong economic data and the overall earnings report of bank stocks exceeding expectations, the three major U.S. stock indexes all rose.

As of the close, the Nasdaq rose 180.92 points, or 1.31%, to 14,038.76 points; the S&P 500 index rose 45.76 points, or 1.11%, to 4,170.42 points, also setting a record high.

The Dow rose more than 300 points to 34,035.99 points, a record high. This is also the first time the Dow’s closing price rose above 34,000 points.

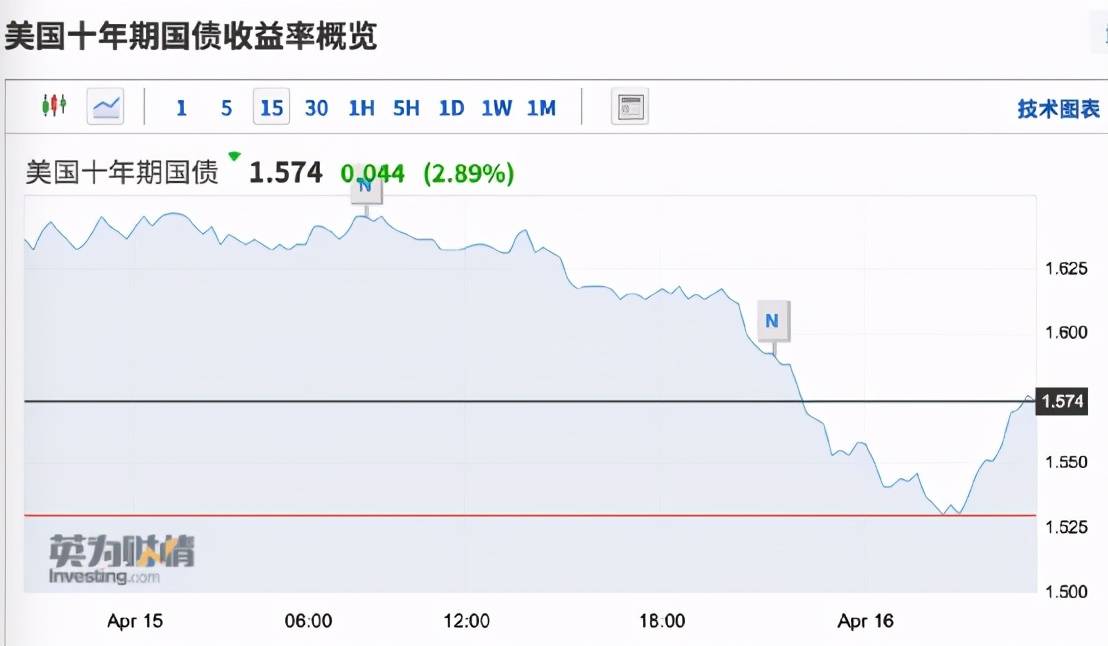

U.S. debt fell unexpectedly

Economic data is very strong, and U.S. Treasury yields should generally go up. But after the United States released dazzling data on Thursday, U.S. Treasury yields unexpectedly fell.

The 10-year U.S. Treasury yield once fell below the 1.530 mark.

On the news, as the largest overseas holder of U.S. Treasury bonds, Japan’s share of U.S. Treasury bonds has hit a record low. On Thursday, local time, the International Capital Flow Report (TIC) released by the US Treasury Department. The report shows that Japan’s holdings of US Treasury bonds fell by US$18.5 billion in February this year, and the total holdings fell to US$1.26 trillion, accounting for 5.9% of the total US government debt, the lowest in history.

Risk aversion warming up

Gold soars

The US sanctions against Russia have increased risk aversion in the market, and the price of gold has risen rapidly. In addition, strong economic data in the United States also makes people more worried about the risk of inflation, which also provides support for gold prices.

The spot gold price was once close to the $1770/ounce mark.

Gold futures once rose above the $1770/ounce mark.

U.S. gold stocks also rose sharply.

The chip giants rose nearly 6%

New energy vehicle stocks have fallen

On Thursday, chip stocks rose very brightly, AMD and Nvidia both rose nearly 6%, and Xilinx rose more than 5%.

On the news, TSMC’s dazzling earnings data boosted market sentiment, confirming the logic of “lack of cores” boosting the chip industry’s prosperity. On Thursday, TSMC announced its financial report for the first quarter of 2021. During the reporting period, TSMC achieved revenue of US$12.92 billion, a year-on-year increase of 25.4% and a month-on-month increase of 1.9%, a record high. TSMC has also substantially raised its revenue growth target for 2021 to 20%, and is expected to grow at a compound growth rate of 10-15% in the next five years, and it is expected that the problem of chip shortages may continue until 2022.

While chip stocks rose sharply, new energy vehicle stocks, which are also technology stocks, fell.

Ideal cars fell nearly 7%, Xiaopeng Motors fell more than 4%, and Weilai Motors fell more than 3%.

Source: China Fund News

You must log in to post a comment.