1, Today, A shares fell beyond imagination! For the broader market, I analyzed it during the weekend, and there may be a big negative line! Mainly, it will fall for a long time. However, the overvalued varieties have not fallen much, but the undervalued financial real estate continues to decline today, and the intensity is not small, the fall is a bit beyond imagination! This is probably not what many people thought of. It is understandable that real estate stocks fell. However, the decline of insurance stocks today is not small. This is a bit difficult to understand. It shows that A-share institutions no longer care about the valuation. Be more concerned about chasing ups and downs!

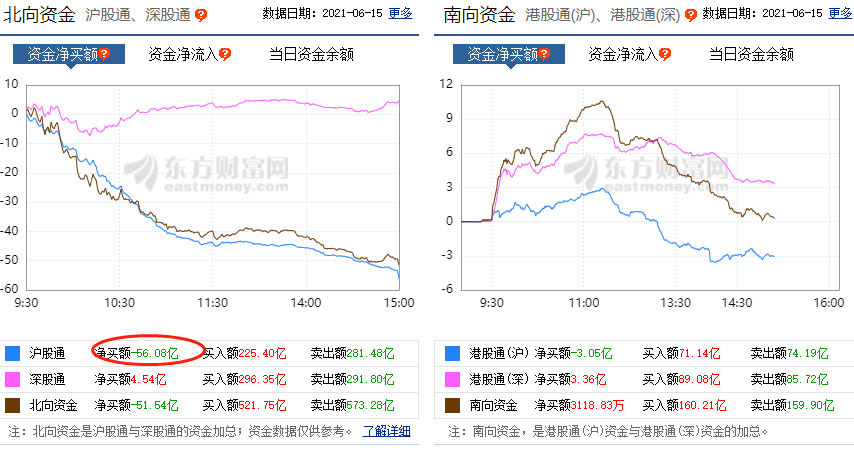

- Due to the slump of financial stocks, there is no doubt that today’s Northbound funds will flow out of the Shanghai Stock Connect. The Shenzhen Stock Connect has not been affected much. In the afternoon, it was a net inflow. Although the volatility of the A-share market is not large, but I did not expect that the undervalued sector was thought to be incapable of falling, but in fact there is still a bottom! The southward funds have not been affected much. Hong Kong stocks fell more than A shares in early trading today. The drop in the afternoon was smaller than that of A shares.

The market closed down 33 points today, or 0.92%, to close at 3556 points. The transaction volume was 444.7 billion yuan. The turnover of the two cities is just over one trillion yuan. There were only 514 gainers and 1408 losers. The net outflow reached 28.08 billion yuan. There are 61 daily limit stocks and 27 daily limit stocks. There are many stocks with large daily limit. Semiconductor technology stocks performed well on the disk, while non-ferrous tourism and financial stocks fell sharply. The concept of Hongmeng rose sharply in the intraday and fell back!

In fact, there hasn’t been much fluctuation in the periphery recently. Last night, the Nasdaq Index was only one step away from a record high. Both the Nikkei Index and South Korea Index are mainly shocks! Only the big A shares performed quite weakly. A shares fluctuated at around 3600 points for a long period of time, and there was no upside for a long time, indicating that the pressure above is quite large. It is not as easy as some experts think 4000 points. It’s so difficult at 3600 points, let alone 4000 points.

5. There was a rare surge in core assets last year. And a little bit regardless of the fundamentals, regardless of performance, as long as the core assets will rise. But this year is different. This year’s core assets must have real materials in order to rise. In other words, only core assets with outstanding performance in a quarterly report will rise. The core assets that performed in a quarterly report have been lying low. In the past few days, low-level core assets continue to break down. Ping An of China and Vanke A are the most obvious examples. Therefore, do not think that these underestimations are very cheap and stable. But it was unambiguous to fall. This is the difference between this year’s core assets and last year.

- The next market is becoming more and more professional. Basically, the agency has the final say. Of course, some hot money will also have some opportunities. Organizations are based solely on performance, and different organizations have different understandings of performance. Therefore, institutions that did well last year may not do well this year. Regardless of the amount of hot money, the Hongmeng concept of the past few days has also been profitable. However, if you want to catch up, you may not be able to make money. Those who can survive in the market are human beings. It’s not easy to cut anyone!

Although the market performance is very weak, I don’t think it should be too pessimistic. According to A-share stocks, if they cannot rise, they have to fall before they can rise again! Therefore, if the recent market only steps back to about 3500 points, it will basically bottom out. Look at the A50 actually fell not so tragically! It’s just that the fall of financial real estate is really unbearable! The differentiation of individual stocks is too serious! Core assets are also looking at performance. When the semi-annual report is coming, it is better to avoid the stocks with mediocre performance!

You must log in to post a comment.