After breaking through the US$2,000/ounce in August 2020 and hitting a record high, the international gold price continued to fluctuate and callback, and it fell below the US$1,700/ounce mark in early March of this year.

Since the end of March, the price of gold has bottomed out and rebounded. Recently, it has successfully exceeded $1,750 per ounce, and the market’s attention to the precious metal market has risen again.

The price of gold bottomed out and rebounded with fire in the precious metals sector

On April 15, the international gold price hit a maximum of 1770.6 US dollars per ounce, setting a new high in the past two months. In the early trading of April 16, the overall performance of precious metals in the domestic futures market was relatively strong. The main Shanghai gold contract reported a rise of 1.39% in early trading to a maximum of 374.08 yuan/gram, which was the lowest of 354.58 yuan/gram at the beginning of March, which has risen more than 5%.

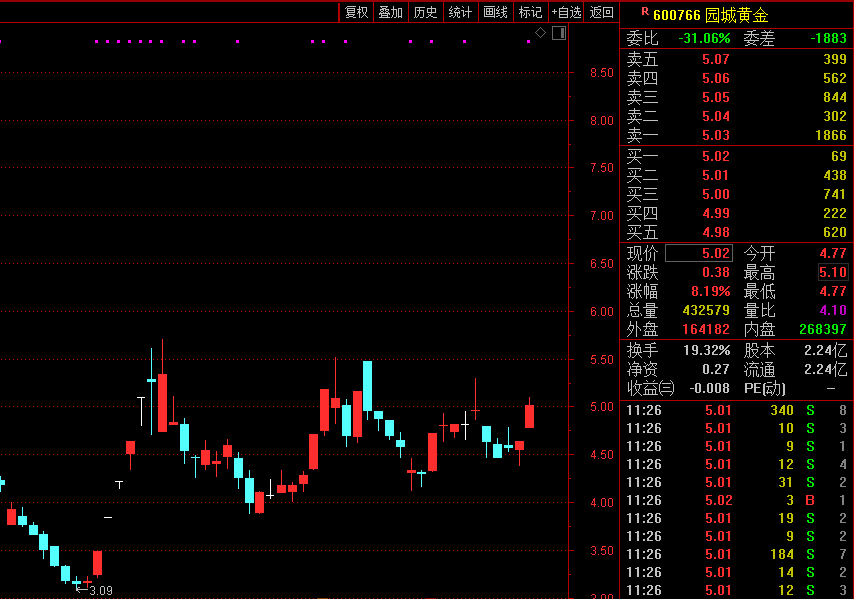

Affected by signs of a bottoming out of gold, the precious metals sector trended strongly in the early trading on the 16th. As of the morning’s close, the Wind Precious Metals Index rose 1.71%, individual stocks Zhongyuan City Gold rose 8.19%, Chifeng Gold rose 5.09%, and Yintai Gold rose nearly 5%.

“The recent rise in gold prices is mainly due to the weakening of the U.S. dollar and the fall in U.S. Treasury yields that have boosted the attractiveness of gold prices. The logic behind this includes that on the one hand, Fed Chairman Powell’s speech made the market believe that easing will continue; on the other hand, the international situation has intensified. The United States will expel Russian diplomats and sanction 20 companies and individuals, and Russia is also prepared to do the same. The degree of retaliation has led to rising global risk aversion. In addition, the central bank’s increase in gold reserves is also the reason for the recent rise in gold prices.”Xu Yang, chairman of Shanghai McRong Information Consulting, said in an interview with a reporter from Securities Times·e Company.

Zhang Wei, an analyst at Zhuochuang precious metals, also believes that international gold prices have recovered from low levels due to the recent weakness of the U.S. dollar and the containment of rising bond yields in various countries. In particular, Fed officials have recently intensively voiced that they have not considered tightening easing and raising interest rates in the short term. On the other hand, with the recovery of retail and consumption exceeding expectations, expectations of higher inflation have been continuously corroborated, so that the rise of social real interest rates has been hindered, and gold The significance of investment and inflation hedging has become apparent, which is good for the price of gold.

In response to the recent rebound in gold trends, Cheng Xiaoyong, director of the Baocheng Futures and Finance Research Institute, also pointed out that the main logic of the recent gold market has evolved into a comparison between the rate of inflation and the rise in the nominal interest rate of the US dollar. The fall in short-term U.S. Treasury yields may be the main reason for the rebound in gold, and the recent fall in U.S. Treasury yields may have a lot to do with the slowdown in U.S. Treasury issuance. At the same time, Biden’s 2.3 trillion infrastructure plan and the rebound in the U.S. service industry price index mean that the momentum for U.S. inflation to rebound has increased. Therefore, in the case of short-term U.S. Treasury yields falling, the rise in US dollar real interest rates has slowed, stimulating some Gold buy order entry.

He believes that since this year, changes in U.S. bond yields are the most important factor affecting asset prices. Since February, volatility in global financial markets has been related to the sharp rise in U.S. bond yields. Not only did U.S. stocks undergo a sharp downward adjustment, but the prices of copper, crude oil, and gold also fell sharply. However, in early April, U.S. bond yields fell to a certain extent, which may be an important reason for the phased rebound in gold prices.

Will the “Golden Bull” appear again?

” Recently, gold has shown signs of bottoming out and rebounding, which may mean that the trend of gold’s high correction that has lasted for two quarters has temporarily come to an end. However, from the long-term mainstream logic, with the popularization of vaccines, the US economic recovery is expected to accelerate, and employment and economic data are significantly better than expected. The market expects that the Fed’s loose monetary policy will end early, and there is an upward expectation of US real interest rates. It constitutes a continuous pressing effect. Zhan Dapeng, a precious metals analyst at Everbright Futures, told a reporter from Securities Times·e Company that in the short to medium term, gold has an opportunity for a rebound. First, judging from the Fed’s statement on expectations management, the asset purchase reduction plan may appear as early as possible. In the first quarter of next year, interest rates may increase in 2023, that is, the market has “premature expectations”, gold “shot” ahead of schedule; second, with the implementation of Biden’s stimulus plan and the launch of the infrastructure plan, the US fiscal deficit continues to expand. It constitutes a medium- and long-term negative for the U.S. dollar, and gold has only a callback expectation and no bear market expectation. Since late March, whether it is the rise of U.S. long-term bond yields or the rebound of the U.S. dollar, the negative pressure on gold has been weakening. This is also gold. One of the signs of bottoming.

“The only concern now is that global gold ETF holdings are still dominated by outflows. Institutions have declining confidence in gold holdings. The weakness has become a consensus in the market. Therefore, when gold rebounds in the second quarter, the increase or decrease in gold ETF holdings will be very high. Importantly, if the capital holding confidence returns, the gold rebound may be firmer and longer-lasting, otherwise it will be short-lived.” He said.

Cheng Xiaoyong also believes that from a long-term historical perspective, 2020 will mark a long-term low in inflation and interest rates. The Federal Reserve also strives to avoid negative currency market repo exchange rates. This means that the real interest rate of the US dollar may enter a long-term period. In the upward cycle, gold investment demand will continue to fall, and there will be little room for gold prices to rebound.

Xu Yang said that from a technical perspective, gold as a whole is currently in a continuous upward phase. But it is not the time to really start the big-stride upward rhythm. The change point of the long-short trend of real gold is in the 1800 area, which is after the 1800s when the real gold strides up.

At the macro level, the price of spot gold rebounded after falling by 10.5% in the first quarter of this year. This is not the beginning of a bear market in the gold market. The yield of U.S. Treasury bonds fell after reaching a peak of 1.75% in the first quarter. This is the price of gold in the next quarter. The rise has created the conditions, and the price of gold is expected to reach $2,000 per ounce at the end of the year. The demand for physical gold jewelry accounts for about half of the total demand for gold. This demand was quite weak last year due to the blockade measures. With the economic recovery and reopening, the market demand for gold will rebound this year. The central bank, which holds about one-third of the total supply of gold, is the key to stabilizing demand. Central banks may increase their gold holdings to diversify concentrated currency risks. In addition, this year is a major year of geopolitical conflicts, which will also boost the safe-haven nature of gold.

These, users are watching

The United States and Russia fall out! Biden signed heavy sanctions, saying that the Russian government interfered in the internal affairs of the United States and will expel 10 diplomats! Russia responds urgently! U.S. stocks pulled another 300 points, and the Dow rose to 34,000!

Rare in history! Dabaima was suddenly hit by the “Sword Breaking Knife” in batches! After 3 days of financing of 2.5 billion yuan, the frenzied leveraged funds have suddenly seen the risk of collapse, “SF and CDF may not be the last case”!

Burst! 36 billion bull stocks once crashed and fell to the limit! The central bank issued a heavy note: The demographic dividend was used comfortably at the time, and the debt must be repaid afterwards! These stocks instantly became popular…

Burst! More than 2,200 US troops died, Biden announced the withdrawal of troops from Afghanistan! The end of military operations in the past 20 years has burned $1 trillion! The first senior official of the Biden government to visit China is here…

Another national sacred car is here! Just now, Wuling Hongguang launched a convertible, which was trendy and popular, and the stock price surged in the late trading! Pickup trucks will be launched in the future…

“Securities Times”‘s new media platform focusing on listed companies

●First-hand information ●First-line interaction

●One-click release ●Settled in the capital circle

▲Small hands, brand new experience! ▲

You must log in to post a comment.