Author: tea and coffee

Source: GPLP Rhino Finance (ID: gplpcn)

“The first stock of children’s clothing” Annel (002875.SZ) performance report was released. Following the “cutting” of its performance in 2019, its net profit in 2020 has fallen sharply.

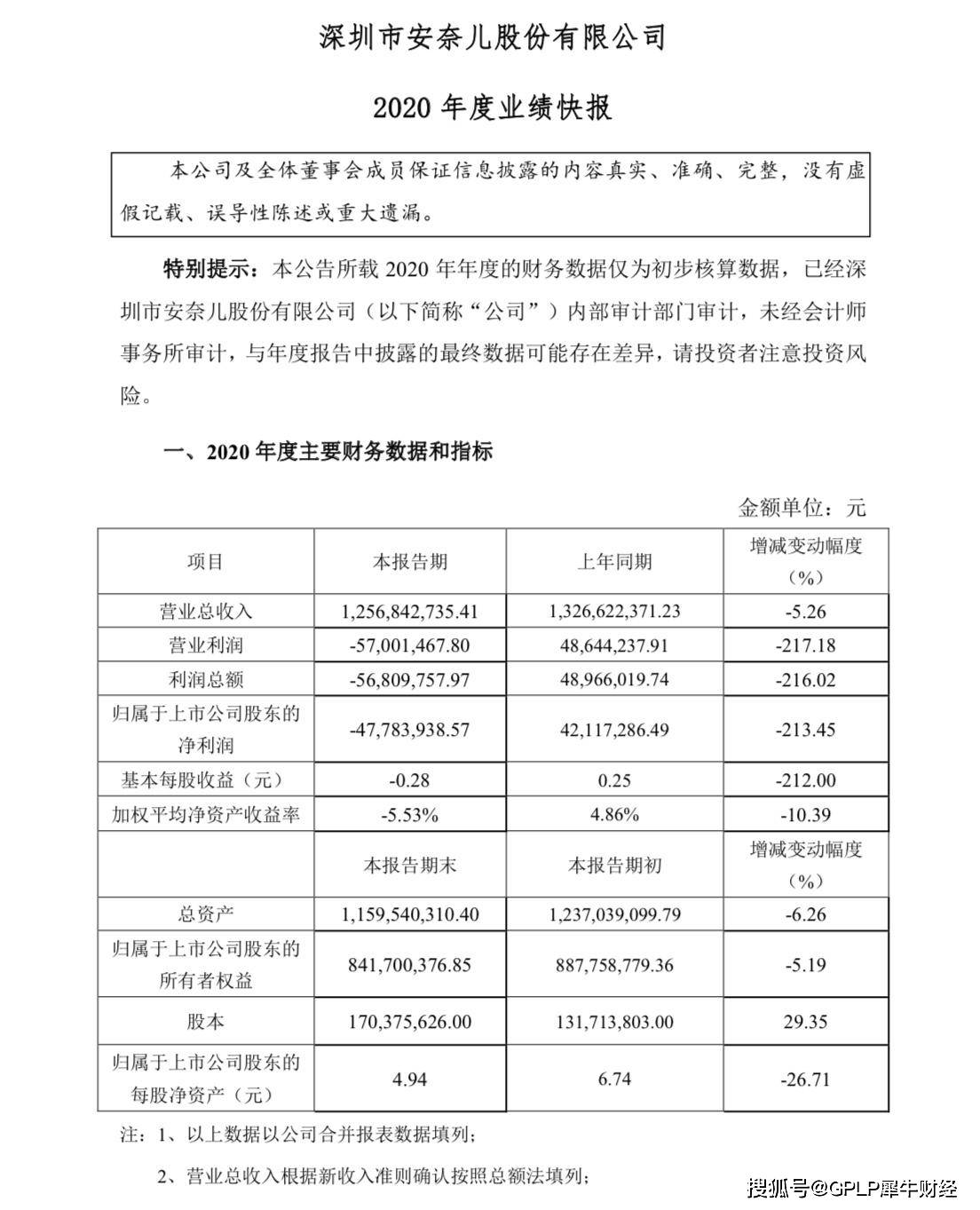

On April 15, Annel released the 2020 annual performance bulletin, stating that it achieved operating income of 1.257 billion yuan, a year-on-year decrease of 5.26%; a net loss of 47,783,900 yuan, a year-on-year decrease of 213.45%.

(Source: Annell’s 2020 performance bulletin)

Public information shows that Anner was founded in 2001 and listed on the Shenzhen Stock Exchange in 2017. It is mainly engaged in mid-to-high-end children’s own brand clothing, which is known as the “first share of children’s wear.”

Net profit declined for two consecutive years

Regarding the changes in performance, Annaer said that due to the impact of the new crown epidemic, its operating income has declined compared to 2019. The direct sales model has caused the related labor costs, rent and management expenses involved in the external lease of stores to remain relatively rigid. , The provision for asset impairment on the balance of long-term equity investment has caused certain adverse effects on its net profit.

At the same time, according to the announcement, Anner’s 2020 operating profit loss was 57.015 million yuan, a year-on-year decrease of 217.18%; the total profit loss was 56.809 million yuan, a year-on-year decrease of 216.02%.

As the “first share of children’s clothing”, Annell, is the decline in its net profit only due to the impact of the epidemic?

In fact, before the epidemic began, Annel’s performance had fallen sharply, and its net profit in 2019 fell by nearly 50% year-on-year.

In 2019, Annel achieved operating income of 1.327 billion yuan, a year-on-year increase of 9.41%; realized a net profit of 42.117 million yuan, a year-on-year decrease of 49.49%. The increase in revenue did not increase profit.

(Source: Annel’s 2019 Annual Report)

Annelle did not specifically explain the decline in its net profit in the 2019 annual report.

It is worth noting that the net cash flow generated by the company’s operating activities in 2019 was -46,172,700, a year-on-year decrease of 203.51%. It is understood that this is the first operating cash flow of Annel since its performance was disclosed in 2012. negative.

Business problems “misfortune never comes singly”

Seeing that the performance fell into the situation of “increasing revenue but not profit”, Annal began to find a way to solve it, but the results were very low.

In 2019, Annier increased its capital in Xinyu Infant with 24 million yuan in cash, obtained a 20% stake in Xinyu Infant, and appointed directors, and announced that it will form a synergistic effect with the well-known brand “Sunshine Mouse” under the cooperative enterprise.

Unfortunately, this cooperation lasted less than a year and ended in failure, and the synergistic effect that Annael hoped to form was not achieved.

Affected by the epidemic, Xinyu Yingtong suffered successive losses, coupled with a series of problems such as improper internal management of the company, until 2020, the company has been unable to issue even its annual financial statements.

When I met Xinyu Yingtong, I thought it was already a headache for Annel, but I didn’t expect that the problem that made him even more headache occurred in the same year.

At the beginning of 2019, Annel was brought to court by Honglian International. Honglian International filed a prosecution with the court on the grounds that Annel infringed on its 5 trademark rights, demanding that Annaer stop the infringement, publicly apologize and compensate 61 million yuan for economic losses.

In the end, Annal lost the lawsuit and compensated the other party with 3 million yuan.

However, misfortunes never come singly. After entering 2020, a large number of Annel’s stores have closed down, from 1,505 in 2019 to 1,280 by the end of 2020.

The children’s clothing industry should have been the most potential sector in the footwear industry. In recent years, the compound growth rate of the industry has exceeded 12%. However, the net profit of Annelle has been declining successively. Is the children’s clothing “not easy to sell”? Or is it Annell’s “not selling well” children’s clothes?

(This article is for reference only, and does not constitute investment advice, and operates at your own risk accordingly.)

You must log in to post a comment.