Every reporter: Ding Zhouyang Du Wei and Shu Dongni

After the slogan “Shoes are not fried” was called out by the platform again, the minibus of the shoe-fried shoemaker typed “Hehe”.

Recently, The limited edition Li Ning sneakers were fired up to 40,000 yuan a pair on the trend trading platform Dewu, and they were removed from the Dewu App and the transaction account was blocked. , The madness and danger of fried shoes has once again attracted the attention of the public.

The last time I was severely hit was in October 2019. The central bank issued a document warning of the financial risks behind the “shoe speculation fever”, including naming and criticizing the trendy shoe trading platforms such as Dewu, nice, stock, and 95 points. At that time, Dewu (formerly known as “Poison App”) and Nice issued a statement that “shoes should not be fried”, but only from the interaction on Weibo comments, netizens did not buy it.

Image source: Weibo screenshot

After a year and a half, the platform once again made a sound of cracking down on fried shoes. Will the market for fried shoes cool down?

Since Li Ning’s sneakers were fired in early April, reporters from the “Daily Business News” interviewed more than ten senior shoe speculators with a long “shoe age”. They generally believe that: The shoe market is temporarily calm, but driven by interests, brand owners, trading platforms, and shoe buyers are still at the “card table”, and the shoe market will not be quiet.

The rise of platforms, opening up the C2C market

Retail investors flood into the “secondary market” of sneakers

In the post-80s to post-95 youths, wearing a pair of Nike and Adi sneakers will automatically “walk with the wind” to gain the capital to show off in the class. NBA enters China, “Slam Dunk” is popular, basketball has become a national sport, and “shoe culture” also has soil in China.

Recalling when he was in middle school, Zhou Shou felt that there were only three things that attracted the attention of others, “playing well, studying well, and looking handsome”, but he didn’t account for the same. Until one time, when he went to school wearing a pair of Nike shoes, he unexpectedly discovered that he was part of the group.

“Going back to the early stages of users, especially in China, students can best demonstrate their individuality in shoes.” Yang Bing, born in Jiangxi in 1986, said in an interview that he has developed a strong interest in basketball since middle school. Like other basketball enthusiasts, good sneakers are what he dreams of.

With interest and business opportunities, Yang Bing and Zhou Shou started their business when they were in college. The former founded the sports information website Hupu and derived it, and the latter founded nice. These two apps quickly developed into the main platform for online sneaker trading, and the business rooted in sneaker culture began.

Image source: Screenshot of Dewu APP

Before these two platforms came out, the sneaker enthusiast Hu Ge mainly bought shoes through the forum. He still retains the bbs website that he used before, although it is now a link that cannot be clicked. “At that time, you had to leave a message in the forum to buy shoes, add QQ to other people, make appointments for offline transactions, and also look at the credibility of the other party.” Brother Hu told reporters.

After Dewu, nice and other apps that carry trendy shoe trading functions are launched, the threshold for buying and selling sneakers has been lowered, and the threshold for frying shoes has also been lowered.

“Before there was a platform, there were transactions in private. Everyone made profits by their own ability.” The shoemaker minibus revealed to reporters, “After the platform appeared, disputes about transactions, such as disputes over defective shoes, were reduced. It’s easier to trade.”

“If the brand sells limited editions, wholesalers get the goods and then sell them to agents, it is the primary market for sneaker trading; then countless retail investors frequently buy and sell sneakers through the platform, which is the secondary market for sneaker trading.” Five-year-old Xiaoyi said, “When I first entered this industry, there was no platform. To buy shoes, you must have dealer resources to get the goods; to sell shoes, you must also have customer resources to ship. The platform has opened up a C2C market. You don’t need to have shoes on your hands, you don’t need to have customers on your hands, you can plunge into the heat of frying shoes.”

In Xiaoyi’s view, the platform has promoted the “shoe-fried shoe fever.” “In 2016 and 2017, I used AJ shoes with discounts, and now there are no discounted shoes. Because of the large number of people playing, the high popularity, and the high demand, the price naturally rises. I can say that the price of sneakers fluctuates like this. It’s so big, 80% of the reason lies in the platform, which gives the public link the entrance to fry shoes. Before the information was blocked, there were few people participating, and there were not so many “downs” in the middle. Now anyone can buy and sell frequently on it, and the number of flips increases, and the price will definitely come up. ”

“Great God” earns one million a month, buys luxury houses and luxury cars

No amount of financing risk can withstand the temptation to make wealth

In order to improve transaction efficiency, the American shoe speculation platform took the lead in launching the Adi, Nike, and AJ index, and nearly ten domestic shoe trading platforms followed suit. Sales charts, ups and downs, price curves…The data that the platform beats is money that never tires, and it stimulates the nerves of players all the time.

At the craziest time, some small platforms even sold sneaker tickets. Retail investors can buy 0.3 pairs of AJ and 2.5 pairs of Adi, and sneakers have completely become virtual securities products. Small loan companies also ran into the market to provide instalment and leveraged services for the shoe speculation platform. The financial snowball of speculation shoes is getting bigger and bigger.

And no matter how high the financing cost and the big financing risk are, it can’t resist the temptation to create a rich myth by speculating shoes.

Image source of Nike stores: Photo by reporter Zhang Jian

“In more than three years, I have made more than 1 million yuan in shoes.” Li Da, who entered the shoe market in 2018, has established his own supply channels in just a few years and has many fixed merchants downstream. When business is good, Li Da can sell two to three thousand pairs of shoes a day. “For example, the AJ bargain that was very popular before. The price I got was 4,000 yuan/pair, and I sold it to merchants at 10,000 yuan. A pair of net profit was 5,000 or 6,000.”

“I’m still earning less.” In Li Da’s mind, the “great gods” in the industry are those “predecessors” who earn millions of dollars a month to buy luxury houses and luxury cars through their shoes.

When he first entered the industry, Xu Huan was also making money. “By directly collecting sneakers at the sale site, I made a small profit of more than 20,000.” Xu Huan recalled to every reporter that since then, she has been out of control. Without a stable source of front-end supplies, she can only sell in the secondary market. Get shoes at a higher price.

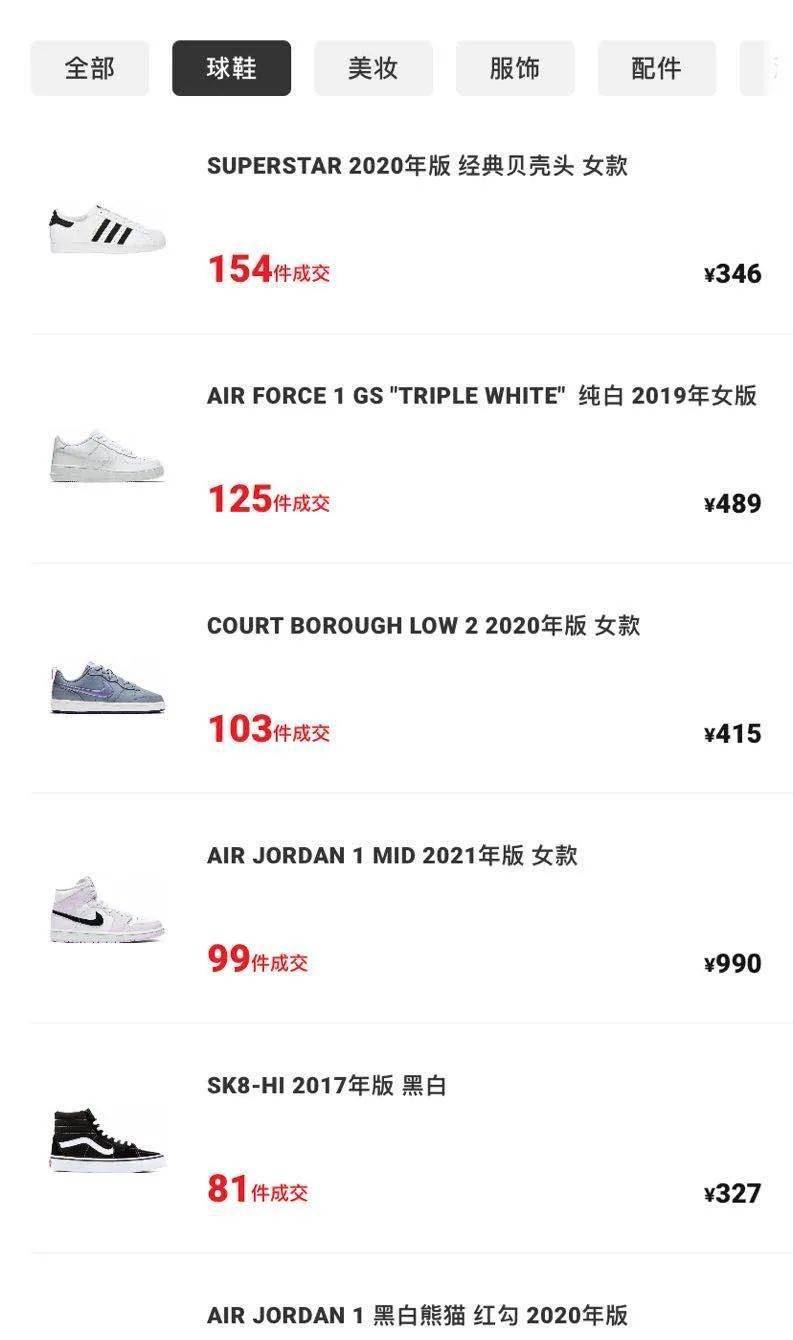

Sneaker resale platform trading volume source: nice APP screenshot

“I don’t know how many times my shoes have turned hands.” After the sneakers were priced up layer by layer, Xu Huan’s profit was meager. In order to make another charge, she began to borrow money from people around her, and she had nowhere to go. After borrowing, they will add leverage to third-party institutions in the form of installments to continue to fry shoes. “Ribunli, now I can’t support it anymore.”

Xu Huan did not disclose the specific amount owed, but she said that she has been unable to repay her debts by frying shoes, and now she has decided to withdraw from the shoe market. “The risk of speculating shoes is high, and once the capital chain is broken, I will lose my money. I understand all these principles, and I blame me for being too young.”

In the shoe market, some people make a lot of money, while others lose money. In Xu Huan’s view, the platform is always the one that makes steady profits without losing money.

Every time the reporter noticed, considering a pair of sneakers priced at 3477 yuan, if you sell on nice, you need to pay 1.2% of the share to the platform, or 41.7 yuan; and for the goods, you need to pay a 5% share to the platform. , Which is 173.82 yuan. However, there is a “cap” on the commission for the goods. When the transaction amount reaches 5,000 yuan and above, the platform share is fixed at 249 yuan. How exactly is the commission rate for gains determined? Every time the reporter asked about getting things, but as of press time, no response has been received.

Nice (left) and Dewu commission comparison. Picture source: Photo courtesy of the respondent

There are also shoe speculators who believe that platform commissioning is not a big problem. “If you don’t have something, nice, where would you go to sell it? (Fried shoes) have already made so much, so don’t worry about the platform’s share. No matter it is the 5% handling fee or higher, I can accept it. “Shoe-fried shoemaker Ahao told reporters that the handling fee for trading sneakers on overseas platforms is higher. “A pair of more than $250 shoes will cost about $30.”

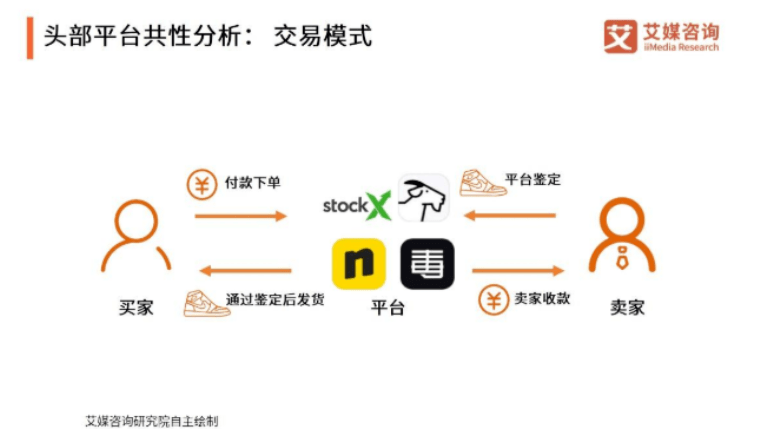

No matter how the market for frying shoes changes, whether it is a high price or a sharp drop in the dive, the shoe fryers need to take risks, but the platform is a stable commission “driving and flooding to ensure income.” Zhang Yi, founder and CEO of iiMedia Consulting Group, pointed out in an interview with reporters that after deducting promotion and operating costs, “the platform is still profitable.”

Image source: iiMedia Consulting

You can grab 200 pairs of sneakers at one time

The robot is the “efficient” ordering program

Those who don’t want to become “leeks” know that for those limited editions with hype value, taking shoes from the “secondary market” means that the price may have been overturned several times. In the “primary market” that is the source of the brand, the cost will be lower if the goods are bought at the selling price.

But getting goods from the “primary market” is not easy. Through open channels, the brand’s limited edition sneakers are as difficult as buying a house lottery. To pass the online lottery, after winning the lottery online, you have to draw another lottery offline before you can finally be eligible for purchase.

In order to increase the “lottery winning rate”, shoe speculators have long used the “scratch plug-in”. “The main purpose of using plug-ins is to receive reminders before the sneakers are sold, so that they can raid the sale pages more accurately and quickly.” Ahao told reporters that there are many free plug-ins in 2016 and 2017, but The charging mode is now open. “The one-stop membership system is about 25 to 35 yuan per month.”

Using plug-ins to grab shoes can only be said to be a step ahead, but whether they can be grabbed and how many can be grabbed in the end is unknown. This has prompted the industry to evolve a more advanced gameplay-robot grabbing shoes.

“Our team’s channels are abroad, and they mainly use robots to grab shoes, and they can grab about 200 pairs of sneakers at a time.” According to Ahao’s description, the robot is equivalent to an “efficient” order processing program. The use of robots can help shoe speculators improve the efficiency of grabbing shoes on overseas official websites when sneakers are on sale.

Nowadays, even the price of robots has risen, and it has become a limited amount of sweet pastry. “There are good robots both abroad and domestic, which is equivalent to selling you an ID, and you have the authority to pay for the ID.” Ahao said, “ The current price of robots ranges from 2,000 yuan/unit to 130,000 yuan/unit, most of which are still between 20,000 and 50,000/unit. With robots, regular renewal is required. In fact, the original price of the robot is not that expensive, but it is basically impossible to buy it now, so there is a high premium. ”

From plug-ins to robots, tools for fry shoes are also being fired.

There are a large number of second-hand sneakers transaction information on the platform. Image source: APP screenshot

In fact, in terms of production links, the sneaker manufacturing industry, which has already been industrialized and mass-produced, basically does not have the problem of technology and capacity supply. But for the brand, selling high-end limited edition sneakers can increase brand value. Scarcity brings “nobleness”, and a game of “hunger marketing” has been played since the beginning.

Take a domestic brand sneaker that has recently been pushed up in the secondary market. The shoe vendor Xiaoye discovered that the store where he often took the goods quickly controlled discounts. “We used to get a 40% discount on shoes, but now we can only get a 20% discount, and there is even no discount. When we get the shoes at the original price and put them on the secondary platform, the price will definitely be higher than before.”

“Later I couldn’t get the shoes at all, and I just asked if I didn’t. Now the store manager just likes to answer, and he sends a message to reply four or five sentences a day. He said that he would sell my shoes at a discount, but in the end they were all released with pigeons, or just “Original price.” Xiaoye vomited, “When I asked for the first time, she said that the store was too busy; the second time, she said that she would consider it, and only the third time she agreed to give me some.” In short, as the prices of certain brands have risen. In order to get shoes that were not so popular before, the shoe-fried shoemaker needs to grind hard and soak with the brand channel.

In Xiaoye’s view, the brand can bear the blame for the price increase of sneakers in the secondary market.

Shoe-fried people are mostly Generation Z

The borders of emerging markets are ambiguous, and supervision is almost blank

The more people interviewed, the harder it is to define each individual involved in shoe-making with a simple “black” or “white”. For example, a minibus whose side business is to fry shoes. His hobby is to study sneakers. “If the price of my hoarded sneakers goes up, the reason for being happy is not just making money, but it also proves that my vision has been affirmed. If I fall severely, I usually wear them myself.”

In this emerging market with ambiguous borders, rules and supervision are almost blank, traps and scams are proliferating, and every shoe speculator will encounter big and small “pits.”

Chen Ru, who only stepped into the “shoe circle” in 2019, “for a time doubted his commercial ability.” Every time the reporter interviewed more than a dozen shoe speculators, most of them were born in 1995 or even after 00. Chen Ru is a middle-aged man with decades of business experience.

“At that time, for investment immigration, I set up a trendy brand store and opened fire. After returning to China, there was nothing wrong with me. I felt that I could do a good job in frying shoes. The amount of money invested in a shoe alone was quite large. I became famous because I lost tens of millions.” Chen Ru told reporters.

Li Ning Sports Brand Image Source: Photo by reporter Zhang Jian (data map)

“I have been trading in the secondary market for luxury goods very early, and the hype price of Rolex’green water ghost’ far exceeds sneakers. But we are basically dealing with mature businessmen. When I placed an order, a watch was worth 70,000 yuan. Even if it was up to 75,000 yuan when it was delivered, normal suppliers would basically hand it over to me at the original price. But these little friends who fry shoes will “pigeon” you without any shame. “

“He (Chen Ru) was deceived by the’pigeon’, and I was deceived directly.” Xiaoyi, a shoemaker sitting next to Chen Ru, said to every reporter: “I once gave people money to get the goods, but they took the money and didn’t ship the goods, so they just rolled the money and ran away.”

Later, the middleman who ran away was arrested. He defrauded a total of more than 6 million yuan, and 1 million yuan from Xiaoyi. And this middleman is just a 21-year-old young man. “With millions in his hand, he can’t control so much money. He may have squandered it. He didn’t realize that this kind of deceptive behavior would bring himself more than ten years of imprisonment.”

Young age, weak legal awareness and risk awareness, these are common problems existing in mainstream shoe speculators.

And what responsibilities does the platform have to shoulder in it?

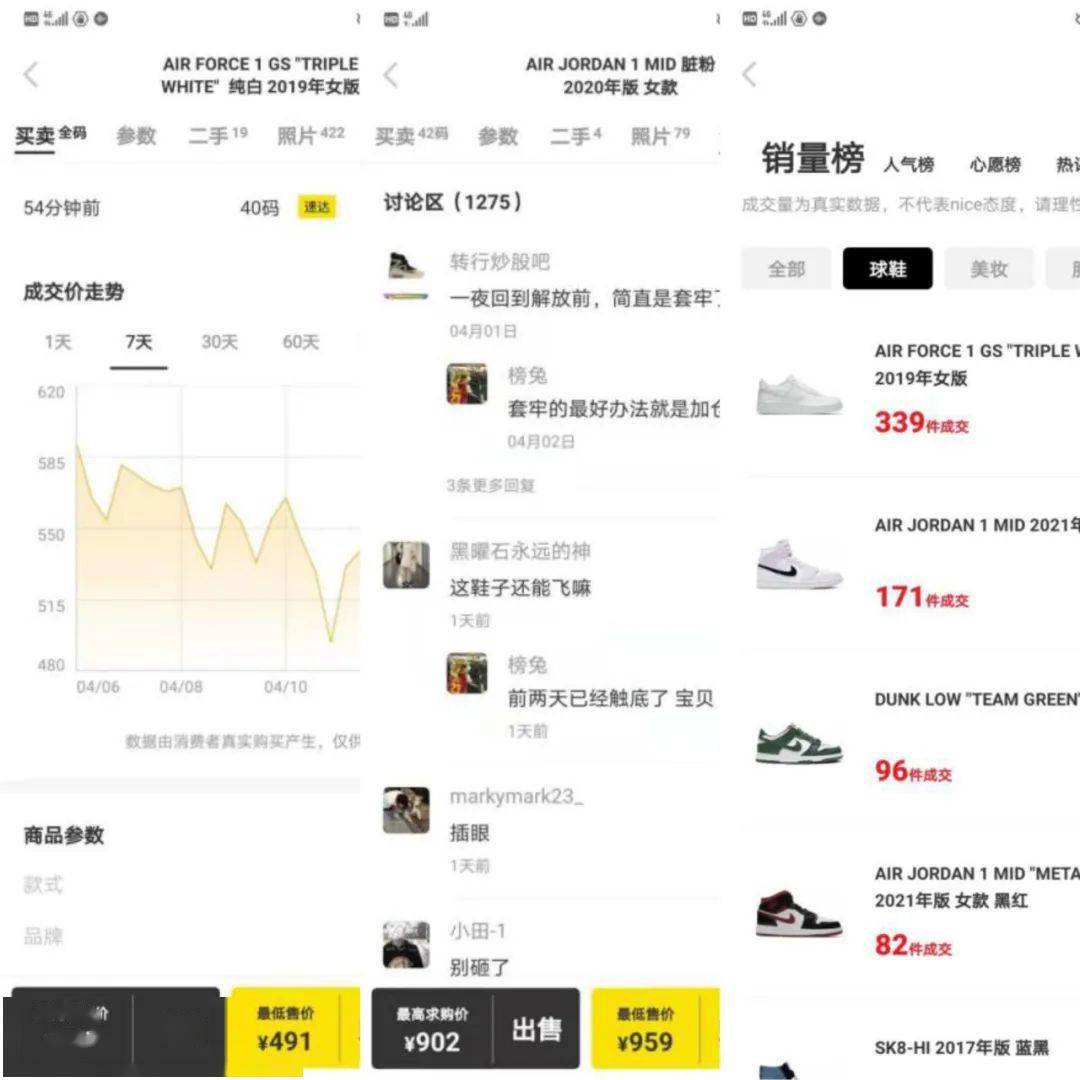

In 2019, after being named by the central bank as the “financial risk of speculating shoes”, nice issued a statement to comprehensively rectify speculation on the platform, including: offline and shutting down the transaction curve, increase list, and sales list; clear the guide in the community , Content and comments that instigate fried shoes.

On April 14th, every reporter opened nice and saw that the sales curve, the increase list, the sales list, and the comments in the community have already made a comeback. Regarding the content displayed on the nice platform, every time the reporter inquired about the nice aspect, as of press time, no response has been received.

Image source: Screenshot of the trading platform

In fact, if the platform wants to monitor the speculation of shoes, the easiest way is to monitor those shoes whose prices fluctuate particularly greatly. “The obvious deviation from the normal brand premium is caused by the hype premium.” Xiaoyi said. “But I think the most important thing to reflect on is that those who come in with a sense of wealth and speculation will not lose money on shoes, but they will also stumbling on others.”

(In the article, the interviewed shoe buyers are all pseudonyms)

Reporter’s Notes | Beware of the aging of the fried shoe market

Generation Z is a buzzword, it seems that once something is grafted to “Generation Z”, it seems a little bit of magic.However, when the shoe-fried shoes meet the Z generation, it is a phenomenon worthy of vigilance.

It is true that on the sneaker trading platform, ID cards are required to be uploaded, and registration is not allowed under the age of 18, but there is no shortage of middle school students who are keen to fry shoes under the age of 18.

Even if they are between 18 and 21 years old, most of them are undergraduates who have not yet graduated. They do not yet have a stable source of income, where does the principal of the shoes come from?

Liu Yonghao once said that his son also invested in the sneaker business and invested 20,000 yuan, but the other party ran away. Liu Yonghao felt that this was a good business education for his children.

The problem is that not every young person comes from a wealthy family, and the greed that cannot stand the temptation of wealth and profiteering is human nature. At this time, if high-interest Internet lending methods that can be mortgage-free are opened to them, once there is a runaway The collapse and the financial snowball are the students who lack the ability to resist risks.

reporter:Ding ZhouyangDu Wei Shu Dongni

Intern: He Qiwei

Editor: Dong Xingsheng Song Hong

Video Editor: Zhu Xingyun

Vision: Zou Li

Typesetting: Dong Xingsheng Ma Yuan

Daily economic news

You must log in to post a comment.