“Core Tips”

Swiping through Douyin, I found a local internet celebrity restaurant with cheap group purchase coupons on the short video. Is it easy to be planted? After failing to test the waters in 2018, Douyin is now back on the local life track, directly hitting the hinterland of Meituan through group purchase coupons. On “Eat, Drink, Play and Live”, short video content is naturally more intuitive than graphics. This time, how much threat does Douyin pose to Meituan?

Author| Shen Fangwei

Edit| Xing Yun

With high frequency, rigid demand, and mature monetization model, the local life track has always been an eye-catching “sweet and pastry”.

As the number one player, Meituan won the “Thousand Regiment War” and built a stable foundation with a strong push and a complete industrial chain.

In Meituan’s business, local life-to-stores and wine tours have always been the “cash cows” with the highest profit margins. In 2020, they contributed 21.3 billion yuan in revenue. Although the business volume is not as large as the takeaway, the operating profit margin reached 38.5%. , Far exceeding 4.3% of the food delivery business.

Nowadays, on the tables of some restaurants in Beijing and Shanghai, a TikTok QR code has been added, showing that you can enjoy discounts when you place orders with TikTok scanning the code.

Meituan and Wang Xing ushered in a new challenger-Douyin.

The byte system led by Zhang Yiming expands without boundaries. In 2021, Douyin has accelerated the promotion of local life business, and has tested water group purchases in many places. Since its official announcement in March, it has been launched in more than a dozen cities including Beijing, Shanghai, Guangzhou, Shenzhen, Nanjing, and Xi’an. The channel has even sunk to the district. County level.

This is generally regarded as a trick for Douyin to attack Meituan’s hinterland. The display of short video content is naturally more intuitive and more attractive than graphics and text. What impact will Douyin bring, and to what extent will it affect Meituan?

- Douyin’s local life ambitions

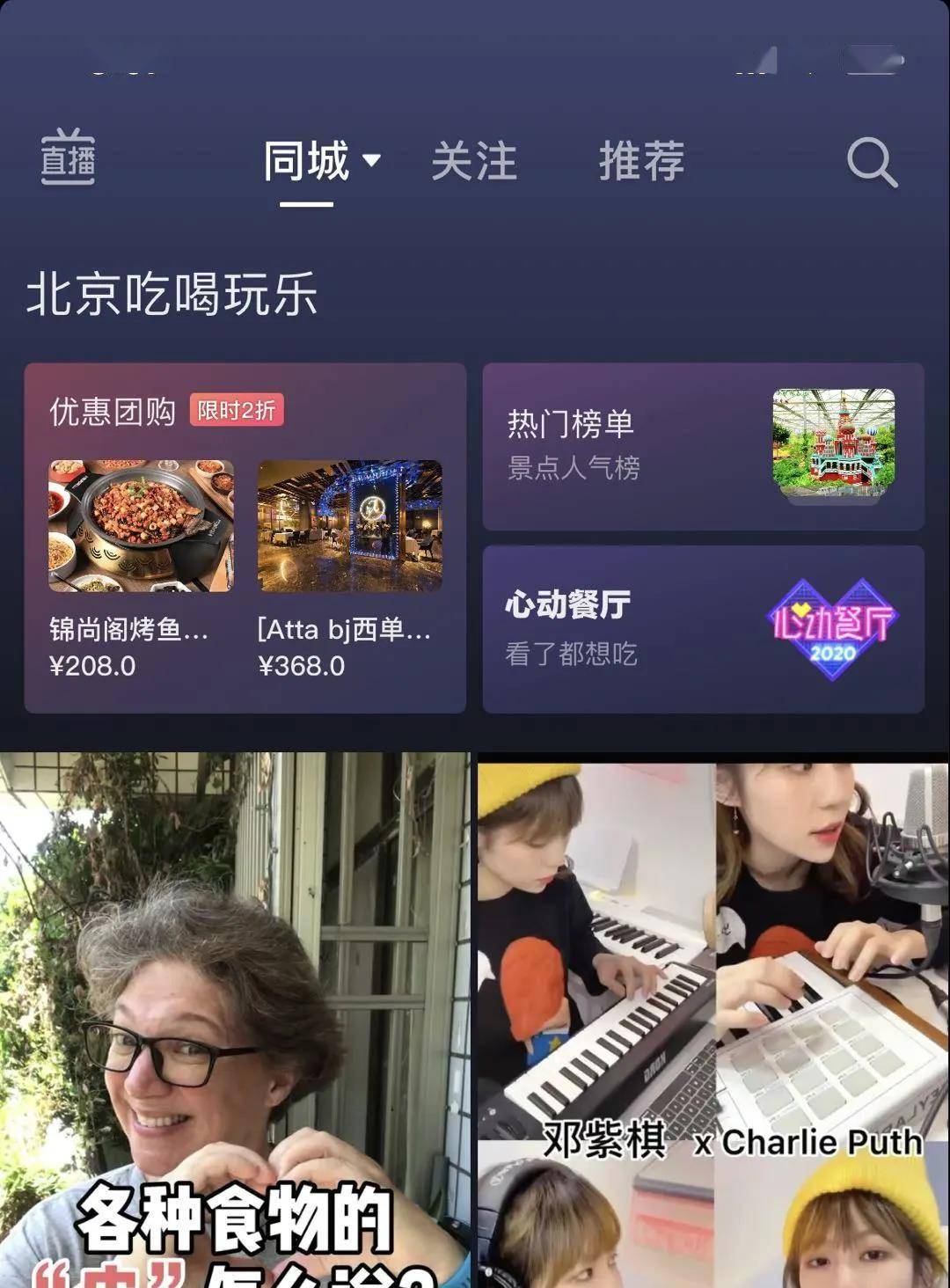

Since February 2021, at the top of Douyin’s same-city page in some cities, a “preferential group purchase” entry has appeared, covering gourmet dining, hotels and guesthouses.

There are also popular lists and heartbeat restaurants on the same city page, all with related video content. Taking Beijing as an example, there are games, accommodations, leisure and entertainment in the game popularity list, and some orders will be redirected to the same city and Ctrip. In other words, you can get services on Douyin for “eat, drink, play, and live” in this city.

Behind this is a new round of battles that Douyin has provoked in local life.

In internal testing in February, the group-buying business officially launched in March is a new attack by Douyin’s “local direct-sale business center” that specializes in expanding local life. It has been rapidly rolled out in first-tier and new first-tier cities.

According to “Latepost” report, this center was established in December 2020. After the original SMB (small and medium customer) business line was withdrawn, about 10,000 employees were transferred to the center in January.

In the second half of 2020, Douyin has taken intra-city, social networking, and search as the most important business lines in the future. This means that the 10,000-person team will focus on local life services such as life services, cultural tourism and catering for customer mining in the future.

This is not the first time that Douyin has tested the local life business, but it is the comeback of BYTE after its failed attack on the local life market.

As early as 2018, Douyin tried to set up a POI (Point of Interest) team, through small and medium-sized merchants to enter the enterprise number, test water coupons and third-party services, etc., but they were not ideal. The project was launched in 2019. Shut down.

According to a byte commercialization department employee told Leopard, that the POI project was resumed afterwards, and various voices filled the team. They believed that the POI click conversion rate was lower than 1%, the user trust was insufficient, and the video content and ecology were not enough. Rich, if you want to do a good job in local life, it is indispensable to deal with these problems.

Over the past two years, Byte has tried to solve such problems and has made a series of adjustments on both the product side and the operation side to help Douyin better adapt to the consumption scenarios of local life services.

Specific measures include, but are not limited to, the upgrade of information aggregation pages, the provision of multiple sets of independent jump menus to improve content scenarios, the introduction of enterprise account upgrades, the initiation of talent shop visits, and the launch of UGC content challenge activities for ordinary users to help the platform accumulate changes. Multiple content resources lay the foundation for restarting the in-store business.

The 2020 epidemic has led to a sharp drop in passenger flow, and a large number of small and medium businesses have begun to actively expand customer acquisition channels and try to participate in marketing cooperation on major platforms to increase store traffic and conversion effects.

During this period, Douyin launched the shop-discovery group plan, with more than 10,000 fans and users who publish high-quality eating, drinking, and grass-planting videos can apply for this service. More shop-discovering videos have also enriched Douyin. Local ecology.

In the coming year, the strong push + Tandian group model will become the main strategy and specific play for Douyin to return to the battlefield of local life.

- Differentiated competition Douyin focuses on new merchants + waist merchants to acquire customers

However, in the current market, Douyin Group Purchase does not directly compete with Meituan’s traditional business, but has opened a differentiated route in all aspects.

The first is the difference in price.

Leopard Change noticed that compared to Meituan’s 60% to 80% discount, 2 to 40% is a common price for Douyin. Among the many shops recommended by Shanghai, most of the merchants’ thousand-yuan package price is only 100- It ranges from 300 yuan.

How can TikTok group purchase be cheaper?

The answer comes from two aspects. The first is the lower entry threshold and the difference in commissions. Meituan merchants need to pay a certification fee of 1,800 yuan, and online group purchase packages need to pay 5-10% of the transaction volume per order.

In contrast, TikTok group purchase only requires merchants to register as users, pay 600 yuan to register a certified company number, and then participate in the gameplay, and there is no commission on transactions, which encourages merchants to give more powerful discount packages and increase the effectiveness of promotion. .

The second is the precise grasp of the positioning of the target business customer group. A staff member of Douyin told Leopard Change that promoters are more inclined to choose two types of businesses as potential promotion targets.

One category is businesses that have been included on platforms such as Meituan Dianping for a certain period of time, but have low overall scores and are eager to improve their reviews; the other category is new businesses that have just opened and have the attributes and characteristics of Internet celebrities. The two types of stores are more difficult to get customers in Meituan Dianping, but they all have a certain budget and room for profit.

After joining Douyin, merchants generally encourage users to write reviews on Dianping and use keywords such as “yindou” to bypass the system shielding, prompting Douyin to buy group meals at a cheaper and more convenient price, and attracting more users who read reviews to Douyin. sound.

At present, Douyin’s local life is still in the stage of promotion and small-step running trials. There is no subsidy plan for the time being, and the opening city has not yet set growth targets, but it does not rule out the provision of subsidies during rapid expansion in the future.

In addition to lower prices than Meituan, creating the illusion of “taking advantage” is also one of the reasons for the large discounts on Douyin.

Take a French restaurant in Jing’an District of Shanghai as an example. The restaurant offers a pasta menu price of 66 yuan, but the group purchase package offered on Dianping shows the price is 88 yuan, while in Douyin’s 2.4% off package, the price of pasta Rise to 188 yuan.

A catering practitioner believes that in the local life business of Douyin based on content recommendations, not only a sufficient number of talents are required to produce high-quality videos for users to plant grass, but it is also important to create the illusion of “taking advantage”. Therefore, businesses have false reports. Price, the phenomenon of large discounts.

In contrast, merchants that have ranked at the top of Meituan Dianping are currently less interested in Douyin group buying. The manager of a 4.77-point Yunnan restaurant chain restaurant in Beijing told Leopard Bian that the restaurant had several promoters visited in early April. , Hoping to launch group purchase packages but were rejected.

There are two reasons for refusing to join Douyin: first, the price has become reasonable, and there is no room for profit; second, the store has established a reputation and has sufficient customer sources. If you blindly expand new customer groups in the short term, it may not only increase the waiting time in the queue. , Reduce the user experience, and may also cause the loss of existing customer groups.

It is difficult to sting Meituan in the short term, but the war in local life will never stop

Douyin has great ambitions for local life, but it is different from Meituan’s play, and there is a huge difference in the scenes between the two.

When people go to a restaurant to pay for a meal, they are used to opening Meituan and commenting to see if there are any coupons available. Behind Meituan follows an active search model to solve the deterministic needs of users.

Douyin uses short videos to solve the random demand. Going to an Internet celebrity restaurant and buying group purchase coupons, this kind of random link will eventually need to be consumed in the store to complete. How high the conversion rate can be is a question.

According to “LatePost” report, as of March 2021, the GMV of Douyin’s local life business that month was less than 40 million yuan.

The basic disk of Meituan’s business far exceeds that of the current Douyin.

At the same time, on the path of realization, Meituan’s local life business follows the high-frequency demand for takeaways to drive low-frequency and high-profit in-store business such as medical beauty and life services. In the past ten years, Meituan has established a solid local life network in nearly 2,800 cities at or above the county level through 9.5 million riders and powerful combat forces. It has an absolute advantage in urban coverage and business categories. , Users and businesses have established an unshakable and stable triangle relationship.

The TikTok recommendation mechanism based on content and algorithms requires dual requirements for content and promotion, and rapid expansion is not easy.

First of all, if a new area has not accumulated enough local grass-growing content, it lacks the core motivation to attract consumers to pay. The current 10,000-person push team can only help Douyin in a small area in some first- and second-tier cities. Promotion.

An anonymous Meituan employee also revealed to Leopard Bian that the Dianping team has launched a response plan based on Douyin’s strategy, but it has not yet announced it. In the past few years, Dianping’s UGC content ecology has also become more abundant, and a route similar to Douyin’s explorer has already existed. Currently, it is not panic about Douyin’s entry into local life.

In his view, in today’s local life service market, new entrants cannot change the complete service system of Meituan Dianping only by relying on traffic. However, Douyin has not yet established a complete offline service system.

The iiMedia Consulting report shows that in 2019, the overall revenue of the in-store service industry reached 200 million yuan, with a steady growth rate of 7%-10% per year, while the current online rate of catering is only 12.7%. The forerunner of this track may have flourished, but there is still a lot of room for development.

Previously, a Byte of internal interview minutes circulated in the market showed that the GMV target for local life in 2021 is 6 billion yuan. The report on April 21 showed that before February this year, BYTE’s goal for local life for the whole year was to buy GMV in the store to reach 20 billion yuan by the end of 2021, and the person in charge of the giant engine responded that there was no decision. Under the target of 20 billion GMV.

In addition to Douyin, Kuaishou, another giant in the short video camp, as well as Alibaba, Baidu, and Didi, who have been deeply involved in the Internet for many years, all have deep or shallow participation in the local life track. Under the rapid disruption of Douyin, other players are also ready to move.

The singularity of the reversal of the situation in this game has not yet come, but a trend is already foreseeable, the war in local life will never stop.

You must log in to post a comment.