Data map

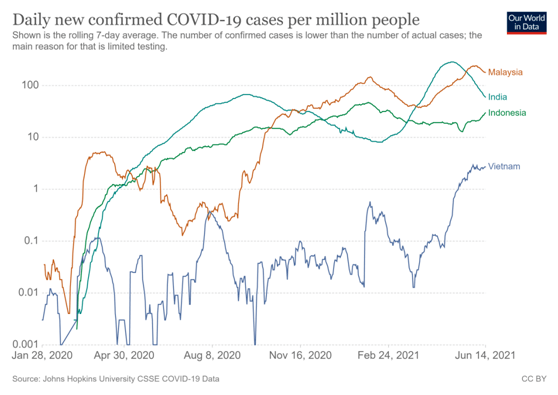

As an important gathering place for the transfer of the domestic electronics industry, emerging market countries such as Vietnam, India, and Malaysia, due to the recent rebound of the new crown epidemic, have caused some factories to suspend operations in some areas, and there is news that industry orders are returning to the country.

A reporter from the Securities Times·e Company found that the current volume of electronic orders returning to China is limited and restricted by factors such as limited production capacity and different division of labor. The corresponding domestic enterprises have limited capacity; on the other hand, due to the epidemic situation and global core shortages, etc. Under the influence, the security of the supply chain has gradually become a consensus, which further catalyzes the diversion, migration, and fluctuation adjustment of electronic products in the international industrial chain.

(As of June 14, 2021, Malaysia, India, Indonesia, Vietnam newly confirmed cases of new crown epidemic data unit per million population data source: Our World in Data)

Reflow of orders but limited production capacity

“There are some overseas orders returning to China, but we are very cautious in taking orders.” As a leading mobile phone contract manufacturer in China, the company has factories in Indonesia and India. Company executives told reporters that these return orders have their own overseas customers as well as other manufacturers’ transfers, but the problem is that the domestic production capacity is now fully loaded.

“Now there is still a shortage of chips such as memory,” the above-mentioned executive told reporters. Due to factors such as the limited capacity of upstream fabs and the stockpile in the industry, the global core shortage problem has not been fundamentally alleviated, which has also affected the ability to receive orders to a certain extent. According to a survey by the market research agency TrendForce, the recent graphics DRAM contract market is still in short supply, and the order fulfillment rate of some small and medium-sized customers is only about 30%. It is expected that this tight supply and demand situation will continue into the third quarter.

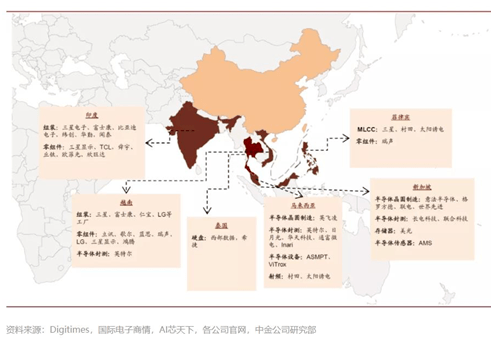

In the semiconductor industry, Malaysia and the Philippines have gathered assembly and test production links, including Intel, Texas Instruments, ASE, A-share Tongfu Microelectronics, Huatian Technology, etc., all set up factories there. Recently, these countries have also rebounded from the epidemic. Malaysia has even started Full movement control will be implemented from June 1st.

However, the reporter learned that the semiconductor industry is not restricted by epidemic prevention and control, and local packaging and testing companies and production lines in Malaysia are still running; and the current domestic packaging and testing companies are generally full-loaded and expanded, and their ability to undertake large-scale return orders is limited.

“We can’t accept domestic orders,” the staff of Huatian Technology’s Secretary Office told reporters that the company’s overseas factories are operating normally and have not been affected by the epidemic. In the work deployment in 2021, Huatian Technology will speed up the increase of new production capacity as the top priority to ensure that the company and Malaysia Unisem and other subsidiaries are in place to form production capacity as soon as possible to meet customer needs and effectively expand market share. The company has planned to increase capital of 5.1 billion yuan, which will be used for the expansion of integrated circuit multi-chip packaging projects.

Domestic head electronic component consignment manufacturers also told reporters, “The panic has increased due to the epidemic. According to our understanding, there are not many return orders in the field of electronic components, which is too exaggerated.”

Faced with the impact of the epidemic on production, companies will consider adjusting orders in different regions. Recently, Taiwan’s packaging and testing plant KYEC was exposed. Affected by the epidemic, adjustments in personnel and operation schedules will reduce the company’s output in June by 30%-35%. Industry insiders expect KYEC to transfer some orders to the company’s Suzhou plant. .

As one of Apple’s suppliers, Lens Technology has a factory in Vietnam. Regarding the impact of the epidemic in Vietnam, the company’s executives told reporters that after the local epidemic, Lens Technology communicated with customers on re-adjusting production arrangements and reached an agreement. Related products have been arranged in Hunan related parks, and the related parks have sufficient production capacity. It is not expected to have a negative impact on customer product delivery.

In addition, Chaoyang Technology is engaged in earphones and electro-acoustic product accessories. The company said in response to investors’ questions that the impact of the Vietnam epidemic on the company is relatively limited. According to reports, Chaoyang Technology has set up two wholly-owned subsidiaries in Vietnam. The upgrade of the epidemic prevention and control measures in Vietnam involves the subsidiary Viet Nam Lusheng belonging to the Beijiang area. Currently, it is actively cooperating with the local government’s epidemic prevention requirements and strictly implementing the epidemic prevention policy; the company It has been coordinating the operations of the two subsidiaries in Vietnam, and has adjusted part of the production capacity and production tasks to another Vietnam Chaoyang Industrial Co., Ltd.

Zhilai Technology, which is engaged in automatic storage cabinets, said that the Vietnam epidemic has had a certain impact on the efficiency of the procurement of some materials and the export of products in the Vietnamese factory, and has not had a significant impact on the production and operation of the Vietnamese factory. The expansion of the new production capacity of the factory is still progressing in an orderly manner, and it is expected to start production by mid-year. The company’s main production base is located in Xianning, Hubei. If the Vietnam epidemic is out of control and the factory cannot produce normally, the Hubei factory will take over the production tasks of the Vietnam factory and will not affect the production and delivery of orders.

The epidemic has not stopped industrial migration

“As far as we know from the industry chain, the current return of electronic orders is mainly small home appliances and handheld products, which has little impact on customer orders such as Apple and Samsung.” Dong Shimin, director of the Yuanchuan Research Institute, told reporters.

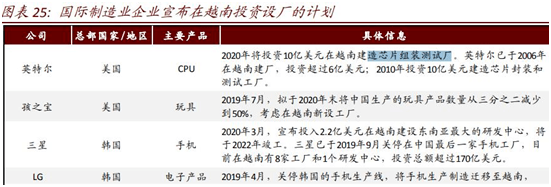

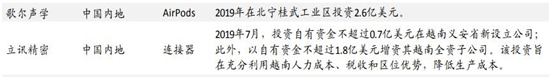

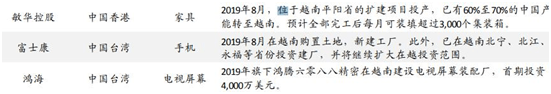

In fact, under the background of Sino-US trade frictions and rising labor costs in the mainland, listed electronics companies have continued to set up factories in Vietnam, India and other places in recent years, even during the epidemic. Among them, Vietnam is the hottest.

According to statistics on foreign investment in Vietnam from the Ministry of Planning and Investment of Vietnam, in the first four months of this year, Vietnam’s attractiveness for foreign direct investment is still relatively optimistic. Funds increased by 24.7% year-on-year; China’s investment in Vietnam has ranked fourth in the first three months of this year, second only to Singapore, Japan, and South Korea. According to Vietnamese statistics, in 2020, China is the third largest source of investment in Vietnam, with a total registered investment of US$2.46 billion, accounting for approximately 8.6% of Vietnam’s total foreign direct investment in the whole year.

Vietnam has also introduced a number of policies to attract foreign investment, becoming an investment destination of “China+1” under the background of Sino-US trade frictions. According to the reporter’s understanding, Vietnam has passed the “Investment Law” (Amendment), “Enterprise Law” (Amendment), “Public Private Partnership (PPP) Investment Law” and other laws on investment and operation, simplifying investment procedures and making it more transparent. And diversify investment forms, and even optimize supplementary investment preferential mechanisms. In addition, Vietnam is a member of the Regional Comprehensive Economic Partnership Agreement (RCEP), the Comprehensive and Progressive Agreement on Trans-Pacific Partnership (CPTPP), and the Vietnam-EU Free Trade Agreement (EVFTA), which facilitates foreign investment. condition.

At the same time, Vietnam also gives preferential taxation. According to the disclosure of Lens Technology, the corporate income tax rate of the Vietnamese subsidiary is 20%. Starting from the year of profitability, it will be exempted for the first 2 years and reduced by half for the next 4 years.

In response to the recent rebound of the epidemic, the Vietnamese government requested that priority be given to key industrial production provinces in northern regions such as Beijiang and Beining. The Vietnamese government has instructed various departments and agencies to give priority to the above-mentioned two provinces to provide the new crown vaccine for vaccinating workers in industrial parks to ensure uninterrupted production and operation. In addition, the government has also introduced financial measures such as loan-free interest rates for customers affected by the epidemic.

From the data point of view, the enthusiasm of A-share listed companies to invest in Vietnam is high, and the electronics industry in particular surpasses other Southeast Asian countries. In 2020, the new crown epidemic is raging around the world, but the number of listed companies raising investment in Vietnam projects has increased significantly. Wind statistics show that since 2020, listed companies such as Yutong Technology, Intellectual Power, and USI have invested in Vietnam’s packaging expansion, precision technology and wearable equipment through convertible bonds, additional issuances, and other projects. In addition, they have jointly created lawns and Huali. The initial IPO fundraising of listed companies such as the Group and Aimer shares also involved local projects in Vietnam, and the total amount of relevant fundraising exceeded 3.4 billion yuan.

Investors’ attention to the direction of the industry’s shift has also continued to increase. According to the statistics of Tianyan Check, the number of survey minutes containing the keyword “Vietnam” began to increase in 2018, and the number of disclosures reached 58. Subsequent to this, the number has basically doubled in 2019 and 2020, reaching 204 by 2020, and it has been close to 100 since this year. seal.

“From the historical background of industrial transfer in Southeast Asia, as early as the 1990s, Japan had already begun to transfer to Southeast Asia and other countries.” Dong Shimin told reporters that from a time point of view, after China joined the WTO, Southeast Asia is also trying to attract industries to the local area. However, at that time, the advantages of labor cost replacement were not obvious, and corporate management experience was insufficient, and no obvious results were achieved in the end.

Dong Shimin introduced that by about 2012, Samsung began to try out the migration of some domestic industries with relatively low technical requirements. Apple suppliers such as Goertek and Luxshare Precision are also transferring, and with the continuous improvement of management level, By training local employees, increase the success rate of industrial transfer.

The executives of Lens Technology introduced to reporters that in recent years, they have continuously improved the layout and development of the industrial chain. They have set up 9 R&D and production bases in China and Vietnam, which can better respond to changes in the external environment, meet the diverse needs of customers, and optimize products. Delivery location and supply capacity to diversify supply chain risks. At present, each of the company’s production parks is self-built and owned by the company, with complete ownership, and the level of automated and intelligent production is stable and leading in the industry.

(Source: CICC)

Apple suppliers intensively go to Vietnam

Tracing the driving force behind the changes in the industry, following customers and the market has become the most critical factor in the migration of the electronics industry, and will even set up factories in different countries according to different customer needs. Sunny Optical executives also introduced earlier that the company’s global layout is customer-centric and follow customers for localized production. For example, the establishment of factories in India is to facilitate cooperation with OPPO, vivo and other customers, and the production in Vietnam is to cooperate with Samsung.

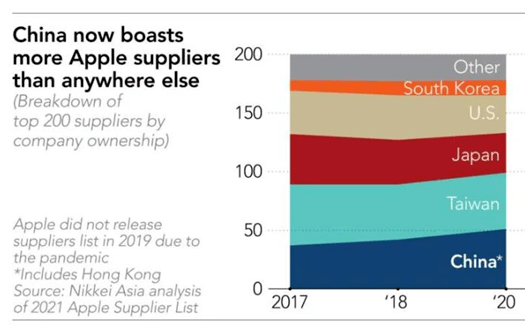

As the vane of the consumer electronics industry, Apple has built a diversified manufacturing system as the company’s long-term strategy. Signs of industrial relocation can also be seen in its latest fiscal year 2020 supplier list: On the one hand, there are 51 suppliers in mainland China (including Hong Kong, China), surpassing the number of suppliers in Taiwan, China for the first time in history; on the other hand, The number of Apple suppliers in Vietnam has increased from 14 in fiscal year 2018 to 21, which is even twice the number of Indian manufacturers in the same period.

If you further compare the details of the changes in the number of manufacturers in the 2018 and 2020 fiscal years, you can find that Apple suppliers in mainland China have become the main increase in setting up factories in Vietnam. Among them, after Goertek and Yutong Technology, Luxshare Precision and Lens Technology A-share listed companies such as A-shares, Lingyizhizao, and Meiyingsen have set up factories in Vietnam, replacing some of the Japanese and Korean suppliers that had previously set up factories there.

Mei Yingsen’s board secretary, Liu Huifeng, also told reporters that the main purpose of going to Vietnam to set up factories is to follow customers and make matching packaging. “It would be too expensive to ship the packaging from China, and we will lose the customer if we don’t go.” As for whether it will continue to increase overseas production capacity in the future, Mei Yingsen said that it is very likely.

Yutong Technology, a counterpart of Meiyingsen and a supplier of Apple, established its first production base in Vietnam as early as 2011, and has now expanded from Vietnam to India, Indonesia and Thailand and established 6 production bases. In April 2019, it used its own (self-raised) funds to purchase the original leased plant and land use rights, at a cost of approximately 60.34 million yuan; in April last year, the company also raised 1.4 billion yuan through the issuance of convertible bonds, including fundraising Invested in Vietnam and Indonesia to expand the production line of electronic product packaging boxes.

On the whole, compared with the domestic Apple industry chain, Southeast Asia’s production capacity is relatively small, and it undertakes the transfer of relatively peripheral and low-end industries, but it is already on the track of gradual growth. In the introduction to investors, the executives of Goertek pointed out that the company’s manufacturing is centered in Weifang and Vietnam is supplemented; the company has been in Vietnam since 2013 and now has a considerable scale. From the perspective of revenue share, last year, Goertek’s overseas revenue contribution reached 50.7 billion yuan, and its share increased to about 88% year-on-year.

According to industry speculation, the production capacity of Apple headsets that Luxshare Precision is engaged in in Vietnam has already exceeded 10% and will gradually increase. In addition, in view of the complexity of the mobile phone industry chain, often mainland manufacturers will be responsible for the production of precision parts, and then shipped to Vietnam and other places to complete the final relatively easy assembly link, and then export overseas.

Compared with Vietnam, India is another electronics industry undertaking. Although the number of Apple suppliers is not as high as that of Vietnam, the majority of Taiwan-based assembly plants are mostly.

Representatives of ODM manufacturers who set up factories in India told reporters that in terms of labor costs, Vietnam is twice as expensive as India. The local labor wage in Vietnam is equivalent to RMB 4,000/month, and Indian workers are about 2,000 yuan/month; however, the company did not choose Vietnam. , But India, the main reason is that in addition to satisfying customers’ global delivery needs, India is also an important mobile phone consumer market, and enjoys preferential tariffs.

From a tariff point of view, India’s local production and assembly also have advantages. The aforementioned manufacturer introduced to reporters that according to past data, the tariff cost of local production in India is about 18% less than that of production in China for the same export to Europe and the United States.

“India has ample local labor, which is cheaper than Vietnam’s labor cost. It is suitable for large-scale assembly, packaging and other relatively low-tech links. Many precision parts are shipped from China to India for assembly.”

According to the IDC report, due to the impact of the new crown epidemic, the Indian smartphone market shrank by 2% in 2020, with a total sales volume of about 150 million units. Among the top five, there are four Chinese brands, namely Xiaomi, Vivo, realme and OPPO. Chinese brand Samsung Electronics ranked second.

The epidemic is also expected to affect India’s local mobile phone production this year. TrendForce further pointed out that the current top five mobile phone brands in the world, Samsung, Apple, Xiaomi, OPPO, and vivo, all have production lines in India or are produced through OEM factories. The output, and the proportion is increasing year by year, the current output Mainly to supply local demand. Based on the local production situation at this stage, it is estimated that the production of 12 million mobile phones in the second quarter to the third quarter of this year will be affected. Affected by the epidemic, India’s annual production volume may decline by 7.5%.

Ensuring the security of the supply chain has become a new consideration for migration

In addition to attracting foreign investment, India is actively promoting its own industrial substitution, using the mobile phone industry as a pilot, and it has begun to show results.

Zhang Zhiwei, chief economist of Insurance Bank Investment, emphasized that India is a country that cannot be ignored. “Although India’s current industrial chain system is not perfect, the current Moody’s government is ambitious and has stronger executive power than before. The PLI (Production Linked Incentive) project will do better.”

According to reports, in April 2020, the Indian government launched a production-linked incentive strategy to promote import substitution in the mobile phone industry. This strategy encourages localized production of mobile phone manufacturers and subsidizes 4-6% of the company’s revenue over a five-year period. At present, about 16 manufacturers have joined the funding program, including Hon Hai Foxconn and Samsung. According to statistics, after the exit of the strategy, participating manufacturers have invested 13 billion rupees and produced more than 20,000 jobs.

The Indian government is also promoting import substitution projects in more fields such as auto parts, home appliances, medicine, solar energy, and communications. Indian officials estimate that the plan will increase output by US$520 billion in the next five years.

Zhang Zhiwei said that “India does not need to be China”. From a macro perspective, India’s population base is large enough, and India will be one of the few countries that can maintain an economic growth rate of 8% in the next 20 years.

In addition to traditional geopolitical factors, under the disturbance of core shortages and epidemics, ensuring the security of the supply chain has gradually become a new driver of promoting the transfer of the electronics industry.

A few days ago, the U.S. Senate passed the “U.S. Innovation and Competition Act,” authorizing approximately US$190 billion to strengthen US technology and research, and separately approved spending of US$54 billion to increase US production and production of semiconductors, microchips, and telecommunications equipment. the study. US Secretary of Commerce Gina Raimondo has said that the funds may be used to build 7 to 10 semiconductor factories in the United States.

In addition to the United States, the European Union and South Korea have also taken measures to strengthen supply chain security, while Southeast Asia and other countries are preparing for corresponding industries. But this is not a cost-compliant plan.

According to a joint study by BCG and SIA, if a fully self-sufficient localized supply chain is established everywhere, at least US$1 trillion in R&D and capital support will be required, and the overall price of semiconductors will rise by 35%-65%, ultimately increasing consumption The cost of electronic equipment

Dong Shimin told reporters that issues such as the epidemic and the lack of cores have made countries aware of supply chain security issues. Although not building a supply chain will increase costs, it may still become a long-term trend; on the other hand, the supply chain is completely shifted from China. Southeast Asia and other places may also have some volatility adjustments due to the epidemic situation and the steady performance of the mainland’s supply chain. For example, the previous plan to transfer all out, the transfer may be reduced after this round of the epidemic.

In addition, the goal of carbon neutrality may also further trigger the trend of industry transfer to developing countries. Zhang Zhiwei pointed out that the United States and China will certainly advance the carbon neutrality target, but countries like Vietnam are objectively not willing to set too high a carbon neutrality target. In the future, the transfer of high-energy, low-end industries will be a major trend.

Regarding the concerns about the hollowing out of the domestic industry due to the transfer of industries to Southeast Asia and other places, representatives of international OEM manufacturers told reporters, “There is no need to worry about this problem.” There is a larger domestic market and a more complete supply chain, and the company is constantly strengthening. R & D strength to improve the level of automation. “After all, it is mainly low-end migration to Southeast Asia and even Brazil.”

Observation: Emerging market countries ignited the movement of new energy vehicles

Emerging market countries in Southeast Asia and other places are no longer satisfied with their role as destinations for foreign-funded industries, and have set the banner of supporting local industries and independent innovation; and new energy vehicles have almost become the same choice.

For a long time, countries such as Vietnam and India have been considered to receive dividends from Sino-US trade frictions. With cheap labor costs, foreign investment conditions, tariff differences and other conditions, they have accepted a large number of low-end mobile phone orders from international customers such as Apple and Samsung. However, after all, the economic structure that relies on foreign investment has natural drawbacks. In addition, domestic labor costs are no longer cheap, and the new crown epidemic has disrupted the pace of industrial transfer to a certain extent. Promoting domestic industrial upgrading has become an important issue considered by emerging market countries.

New energy vehicles are rare innovation carriers that can gather upstream and downstream industries extensively, and it is not difficult to understand that they have been selected as an important option for development. From the perspective of the path, emerging market countries will take advantage of domestic manufacturing, start with the introduction of foreign brands, and implement localized production. They will also join the supply chain of China’s new energy automobile industry to incubate their own car-making forces.

According to the news, Tesla has begun to recruit sales and marketing directors and human resources directors in India; this will be Tesla’s latest response to the Indian production-linked incentive plan (PLI). Under the PLI plan, the Indian government of Moody’s encourages international manufacturing giants to produce locally in India and export them all over the world. In addition, India has approved a plan worth 181 billion rupees (2.5 billion US dollars) to increase the battery storage capacity to 50GWh.

In addition, as a major automobile producer in Southeast Asia, Thailand has been actively developing new energy vehicles, aiming to become an electric vehicle manufacturing export center in Southeast Asia, and has formulated a strategic plan for the development of new energy vehicles, with the goal of basically replacing fuel vehicles with electric vehicles after 2036. .

In May of this year, Hon Hai Precision signed a memorandum of cooperation with Thai National Petroleum Corporation to establish an open platform for the electric vehicle industry in Thailand to produce electric vehicles and provide key To launch new models. Prior to 2018, BYD delivered 101 E6 new energy electric vehicles to Thailand, and local Thai companies also signed an agreement with BYD to plan to introduce another 1,000 E6 electric vehicles in the next few years.

Indonesia, on the other hand, is making use of its advantages in resource mines to develop new energy vehicles. It is understood that Indonesia has the necessary minerals for new energy vehicle batteries such as nickel ore, cobalt, and copper, and plans to become a global production center for electric vehicle power batteries. The Indonesian government aims to export 200,000 electric vehicles by 2025, or allow local brand electric vehicle exports to account for 20% of total motor vehicle exports.

In December 2020, the new energy automobile battery manufacturing giant Ningde Times has signed a contract with the Indonesian government to invest 5 billion US dollars to build a lithium battery plant. The project is scheduled to be put into operation in 2024. This will be the second time of the Ningde Times after the plant in Thuringia, Germany. Overseas factories.

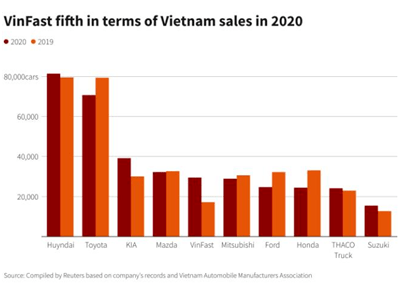

Vietnam has also begun to develop new energy vehicles, and the pace is faster. In the past two years, as the government has introduced support policies for the development of electric vehicles, the sales volume of electric vehicles has increased at an annual growth rate of 500,000 to 600,000, and local enterprises have been actively cultivated.

Vinfast is an automobile subsidiary of Vingroup, Vietnam’s largest comprehensive enterprise group, and the first automobile manufacturer in Vietnam. It has become the fifth largest automobile brand in Vietnam last year and plans to go public in the United States. The latest valuation exceeds US$50 billion, which is close to Wei Come by car.

(Sales of VinFast and other auto companies in Vietnam in 2020)

In March of this year, the Taiwanese solid-state battery manufacturer Huineng Technology and VinFast recently announced that they have signed a memorandum of cooperation (MOU) to establish a joint venture company in Vietnam to increase the commercialization of local solid-state batteries; in addition, Hon Hai also reported a plan to acquire VinFast electric car production line news, and VinFast hopes to retain the electric car block business.

A-share listed companies have also begun to share in Vietnam’s electric vehicle projects. According to Feilong’s introduction to the media, the company has been appointed by VinFast for the electronic water pump and electronic three-way valve project of three pure electric vehicles. It is expected that the first vehicle will be mass-produced in October 2021; the Vinfast pure electric vehicle project and The off-road vehicle project will bring more than 100 million yuan in sales contribution to the company.

You must log in to post a comment.