The disclosure of the 2021 quarterly report of public funds officially ends.

In the early trading on April 23, the three major stock indexes fluctuated slightly, and individual stocks in the two cities fell more and rose less. 3184 individual stocks fell, and market sentiment was weak. As of the close, the Shanghai Composite Index rose slightly by 0.05%, the Shenzhen Component Index rose 0.75%, and the ChiNext Index rose 1.67%.

In terms of sector hotspots, the healthcare sector rose sharply, with Yihua Health, Dabo Medical and Gongdong Medical’s daily limit, and Aier Ophthalmology rose 11.74%. Resource stocks and technology stocks weakened, and individual stocks in the coal sector and digital currency sector led the decline. Beijing Capital bought 5.318 billion yuan in early trading, including 2.86 billion yuan in Shanghai Stock Connect and 2.457 billion yuan in Shenzhen Stock Connect.

In early trading, institutional holdings picked up. Among the leading stocks in the industry, the leading pharmaceutical companies have gained the highest momentum. Aier Ophthalmology rose 11.74%, Mindray Medical rose 5.97%, and WuXi AppTec rose 5.58%. Group stocks such as Haitian Flavour, Midea Group and Oriental Yuhong rose more than 3%.

U.S. stocks dive in the market, Biden wants to tax the rich

According to Bloomberg News, not only for companies, the Biden government also plans to increase taxes for high-income groups. According to people familiar with the matter, US President Biden will propose to nearly double the capital gains tax rate for the wealthy to 39.6%. Together with the existing investment income surcharge, this means that the federal tax rate for investors may be as high as 43.4%.

The person, who asked not to be named, said that the plan will increase the capital gains tax rate for people with an income of $1 million and above from the current 20% to 39.6%. The plan has not yet been made public. Biden is expected to announce this proposal next week as part of the tax increase to fund social expenditures in the upcoming “American Family Plan.” Then White House Press Secretary Jane Psaki said that Biden believes that the expenditures (planned by American families) may come from the richest people, but the plan has not yet been finalized.

As soon as the news came out, U.S. stocks plunged during intraday trading. The Dow once fell more than 400 points, closing down 0.94%, the Nasdaq fell 0.94%, and the S&P 500 index fell 0.92%. Although the news is still uncertain, the market reacted quite violently. On the one hand, the market is worried that the wealthy will dump a large amount of stocks at the capital gains tax rate, creating panic.

Public fund first quarter report disclosed

Yesterday, the disclosure of the 2021 first quarter report of public funds officially ended . Since the Spring Festival, the A-share market has adjusted downwards as a whole, and most of the holdings of public fund holdings have pulled back sharply, and many of the new foundations who entered the market in January and February have faced substantial losses. According to statistics from Tianxiang Company on April 22, due to the A-share market pullback, the overall loss of public funds during the first quarter of this year exceeded 210 billion yuan; in the fourth quarter of last year, the overall profit of public funds reached 820 billion yuan.

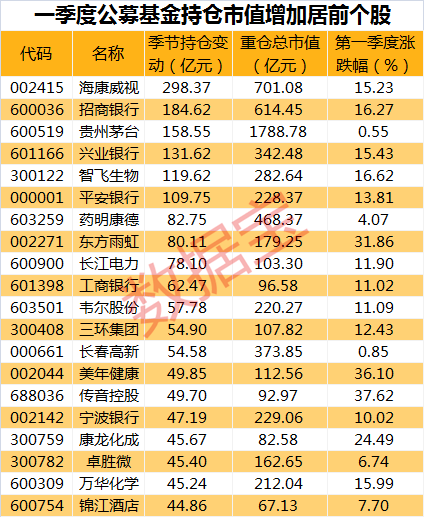

The Securities Times·Databao sorted out the heavy holdings of A-shares of public funds in the first quarter. From the perspective of the total market value of the holdings, compared with last year’s annual report, the top ten heavyweight stocks have not changed much. Kweichow Moutai and Wuliangye hold the first and second positions in public holdings. Hikvision gained a large number of public funds to increase positions and entered the top three positions. China Merchants Bank gained 18.462 billion yuan in public funds in the first quarter, and it newly entered the list of the top ten heavy stocks.

In terms of different industries, bank stocks ranked first in the amount of public fund increase in the first quarter, and the market value of holdings increased by nearly 70 billion yuan. In addition to China Merchants Bank, the market value of public equity funds held by Industrial Bank and Ping An Bank increased by more than 10 billion yuan. In terms of performance, bank stocks all had good returns in the first quarter, with an average increase of 6.26%, 13 bank stocks rose by more than 10%, and the Bank of Nanjing and Postal Savings Bank rose by 25.25% and 22.80% respectively in the first quarter.

Other industries that have a lot of increased positions include the pharmaceutical and biological, electronic, and chemical industries, and the total market value of holdings has increased by more than 30 billion yuan. In the first quarter, the increase of public funds in general tended to pro-cyclical and undervalued stocks, and the enthusiasm for the long-term track of medicine, food and beverage, etc. remained unabated.

While public funds increased their positions in bank stocks in large numbers, the market value of non-bank financial industry positions decreased the most, and holdings of heavy stocks decreased by 34.933 billion yuan. Other industries where the market value of holdings have decreased include electrical equipment and household appliances that have decreased by more than 10 billion yuan, and the market value of holdings of communications, media, computers, and national defense and military industries has decreased slightly.

Based on the statistics of changes in the market value of public fund holdings, there are 5 stocks each in the banking, electronics, and biomedical sectors among the top 20 stocks. The pharmaceutical and biological sector stocks include Zhifei Biotechnology, WuXi AppTec, Changchun High-tech, Meinian Health, and Kanglong Chemical. The electronic sector includes Hikvision, Weir, Sanhuan Group, Transsion Holdings, and Zhuoshengwei. In the first quarter, public fund plus positions rose by an average of 15.34%. Among them, Oriental Yuhong, Meinian Health, and Transsion Holdings rose by more than 30%.

China Merchants Securities pointed out that there are no obvious signs of collapse of public funds. The consumer sector, the food and beverage industry and the pharmaceutical industry are still the most important sectors and industries for public funds. The reason why active public funds have such “falling but not breaking up” results is related to the fact that the fundamentals of these group stocks have not significantly weakened. The high-growth white horse stocks are still the first choice of current public fund managers.

Early morning capital flows to these stocks

In the early trading, a total of 62 stocks received a net inflow of over 100 million yuan in main funds, of which BOE A received a net inflow of main funds of 1.073 billion yuan, which was the top , Rose 1.69% in early trading, Xiaokang shares, Kweichow Moutai, and Sungrow received a net inflow of more than 800 million yuan.

Xiaokang shares in the past five trading days received a total of 4 daily limits and 1 daily limit. The company previously issued a risk warning announcement, stating that the news report stated that the way for the company to expand the marketing channels of Cyrus was normal production with a third party (referring to Huawei). Operating cooperation, and reminded that the expected loss for 2020 is 1.38-17.8 billion yuan.

From an industry perspective, a large amount of the main funds flowed into the medical and biological, electrical equipment sectors in the early trading, and the net outflows from the computer, environmental protection and real estate sectors were the top ones. New energy vehicles have once again been favored by major funds, and Ganfeng Lithium, Tianqi Lithium, and Ningde Times have received a net inflow of more than 200 million yuan in major funds.

You must log in to post a comment.