Author丨Li Wenxian

Produced丨Sohu Finance

It has been a year since the sale of Baicao Wei, and I missed you for announcing the focus on the main business of red dates, but you have repeatedly fallen into doubts from investors.

On June 14, I really want you to receive an annual report inquiry letter from the Shenzhen Stock Exchange, and you were asked to respond to 11 questions about the sale of Holmes, performance, and the decline in the gross profit margin of jujube products.

Since the delivery was completed in June last year, I miss your net profit for two consecutive quarters. In 2020, the gross profit rate of jujube and related products is 29.34%, a year-on-year decrease of 3.46%.

One year after the release of the share repurchase plan, I really want you to significantly reduce the repurchase ratio. During the period, the second largest shareholder Hangzhou Haohong Industrial Co., Ltd. (hereinafter referred to as “Hangzhou Haohong”) reduced its shareholding nine times and cashed out about 180 million yuan in total. .

Since the announcement of the reduction of the repurchase ratio, I miss your share price plummeting for 5 consecutive trading days. As of today’s close, I miss your share price at 10.30 yuan, down 1.62%.

After selling Baicaowei, I miss your net profit for two consecutive quarters.

After selling Baicaowei, I really miss your revenue in 2020.

The annual report shows that in 2020, I miss you to achieve operating income of 3.001 billion yuan, a year-on-year decrease of 49.65%.

On February 23, 2020, I miss you an announcement that it will sell 100% of Baicaowei’s equity. The buyer is Pepsi Beverage, a subsidiary of PepsiCo. The negotiated transaction price of the two parties is US$705 million, which is approximately RMB 5 billion.

On May 14th last year, I missed the transfer of the equity you held in Holmes (that is, Baicaowei) to Pepsi Beverage. On June 2nd of the same year, I missed the announcement that you had received US$698 million from Pepsi.

According to the disclosure, from the first quarter to the fourth quarter of 2020, I miss you operating income of 1.773 billion yuan, 713 million yuan, 250 million yuan and 264 million yuan, respectively. The third and fourth quarter revenues are less than the sixth quarter of the first quarter. One part.

At the same time, in the third and fourth quarters, I miss you a loss of 18 million yuan and 83 million yuan in net profit respectively in the two quarters. After deducting non-net profits, you will lose three consecutive quarters. The second, third, and fourth quarters will lose about 114 million yuan, 17 million yuan and 19 million yuan.

The Shenzhen Stock Exchange asks you to combine the situation of comparable companies in the same industry, as well as the seasonal characteristics of the company’s business (if any), market demand changes, product price trends, cost and expense confirmation basis, and changes in amounts, and explain the quarters of the reporting period. The reasons and reasonableness of the large fluctuations in financial data, and whether there is an inter-period recognition of income or expenses.

Jujube business revenue declines year after year, gross profit margin declines 3.46%

Before selling Baicaowei, I miss your jujube business has been declining year after year.

From 2017 to 2019, the revenue of I miss you jujube products were 961 million yuan, 868 million yuan, and 735 million yuan, respectively, accounting for 23.61%, 17.54%, and 12.33% of the revenue. Revenue has fallen for two consecutive years.

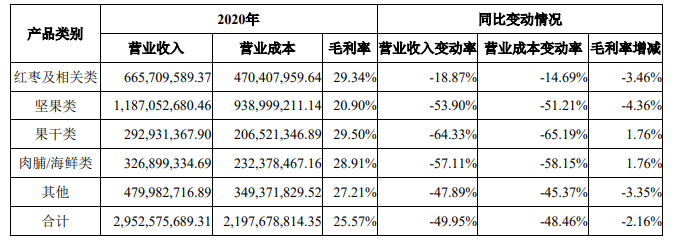

In 2020, I miss your jujube revenue of approximately 666 million yuan, a year-on-year decline of 18.87%, and a gross profit margin of 3.46%.

Compared with jujube products, nuts have contributed 1.187 billion yuan in revenue, which is nearly twice that of jujube business, but they are also facing a decline in gross profit margin.

The financial report shows that in 2020, the gross profit margin of I miss you nuts products is 20.90%, a year-on-year decrease of 4.36%.

The inquiry letter requires you to combine marketing model, product positioning, market share, cost structure and other factors to explain the reasons for the decline in the gross profit rate of red dates and nuts during the reporting period, and analyze whether related factors will continue to affect the company’s production and operation.

I miss you announcing the return to the main business of jujube, and decided to terminate the contract of 4770 acres of land leased by the subsidiary Xinjiang Jujube Agriculture and Forestry Co., Ltd., and concentrate resources on the company’s own high-quality raw material base.

After the termination of the land lease agreement, you no longer own the ownership of the jujube trees, employee dormitories, warehouses and other ground attachments on the corresponding land, and the remaining land lease fees paid will no longer be returned. The total asset loss is 45.66 million yuan.

The inquiry letter requires you to estimate whether the cost of using the leased land to obtain raw materials such as red dates is significantly different from the cost of the company obtaining raw materials such as red dates through other channels. Combined with the reasons for your company’s early termination of the land lease, further explain the company’s termination of the land lease Whether it is conducive to safeguarding the interests of listed companies.

At the same time, according to the disclosure that I wanted to focus on the main business of red dates when you sold the shares of Holmes, it explained whether the company took other methods to consolidate the supply of upstream raw materials while terminating the 4770 mu land lease of the subsidiary Xinjiang Dazaoshu Agriculture and Forestry Co., Ltd. .

The repurchase plan has shrunk sharply, the second shareholder reduced their holdings and cashed out 180 million yuan

I really miss you to change the stock repurchase plan, which also caused investor complaints.

On June 3, 2021, I really want you to disclose the “Announcement on Adjusting the Share Repurchase Program” stating that the number of shares to be repurchased will be adjusted to no less than 41.2 million shares and no more than 67.2 million shares.

Compared to the most embarrassing repurchase plan in history that was thrown out in June last year, the number of shares you bought back has shrunk dramatically.

I really want you to disclose that the number of shares repurchased is no less than 113 million shares and no more than 226 million shares, accounting for no less than 21.91% and no more than 43.83% of the company’s total share capital. The repurchase price does not exceed 13 yuan per share.

As of May 10, 2021, I really want you to repurchase approximately 28.79 million shares through centralized auction trading, accounting for 5.58% of the company’s current total share capital. The highest transaction price is 13 yuan per share, and the lowest transaction price is 10.93. Yuan/share, the total turnover is about 339 million yuan.

During the period, Hangzhou Haohong, the second largest shareholder, reduced its shareholding 9 times, with a cumulative reduction of 13.84 million shares. The number of changes accounted for more than 3% of the outstanding shares. The average transaction price was 11.95 yuan to 13.79 yuan, and the cumulative cash out was about 180 million yuan.

After the announcement of the adjustment plan, I miss your stock price plummeting for 5 consecutive trading days.

The inquiry letter asks, I really want you to further explain the reason and rationality of the company’s adjustment to the repurchase plan in the past 12 months before the shareholders’ meeting reviewed and approved the share repurchase plan, and whether there is a situation of using repurchase matters to cooperate with relevant entities to reduce holdings Wait.

You must log in to post a comment.