Although the first anniversary of the unprecedented negative oil price “black swan” event has passed, its impact on the market has not disappeared.

Brokers China reporter noted that in recent times, many banks have adjusted their precious metal businesses one after another. For example, if they have raised investor risk tolerance limits, they have also gradually shut down and suspended their precious metal businesses.

Some senior executives close to major banks revealed to the brokerage China reporter that in the current international environment, banks’ initiatives are mostly voluntarily shrinking in response to regulatory requirements, aiming to take precautions. The reporter also learned from some large state-owned banks and joint-stock banks that current banks are putting “preventing business risks” to the forefront, and business adjustments are also out of consideration for risks and hedging responsibilities.

Zhou Maohua, an analyst at the Financial Markets Department of Everbright Bank, told reporters that the current adjustment of precious metals business has limited overall impact on domestic investors. First, domestic banks have not completely closed such business windows. Second, the domestic futures market has developed very rapidly and the market depth has increased significantly. .

Tightening of precious metals business

In fact, since March, a number of banks have announced their tightening plans for precious metals business. If there are restrictions on raising the risk tolerance of investors, there are also measures such as gradual shutdown and suspension of precious metals business.

“Considering the high risk in the precious metals market, ICBC will further restrict its account-based precious metals business in the future. For customers who have account-based precious metal holding balances, it is recommended that you choose the opportunity to reduce your holdings to prevent and control your own risks.” ICBC pointed out in a recent announcement.

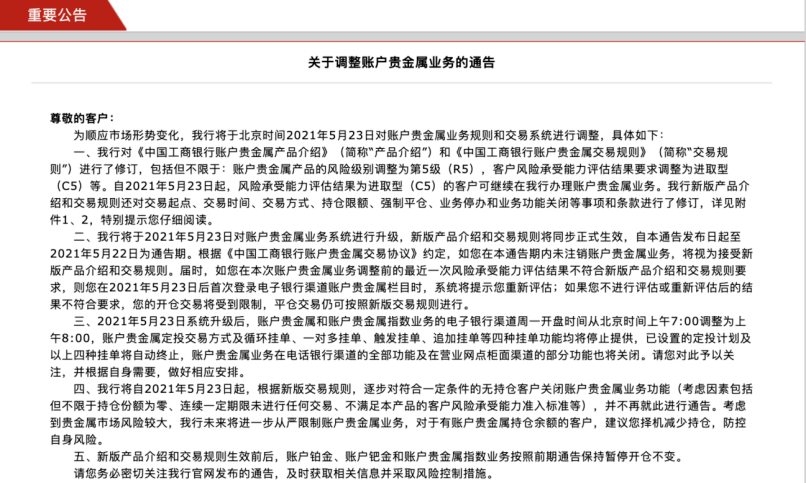

ICBC The official website announced on April 20 that in order to comply with the changes in the market situation, the bank will adjust the account precious metal business rules and trading system on May 23 this year, including but not limited to: raising the account precious metal product risk level to level 5 (R5), and the requirements of customer risk tolerance assessment results are adjusted to an aggressive type (C5); the account precious metal business functions are gradually closed for customers who meet certain conditions without positions.

April 9th, China Merchants Bank According to the announcement, the risk level of the two-way paper gold and silver and real paper gold and silver business has been adjusted from the original “R3 medium risk” to “R5 high risk”. Existing customers whose risk assessment results are lower than “A5 (aggressive)” cannot conduct two-way New opening transactions for paper gold and silver and new purchase transactions for real paper gold and silver. At the same time, adjustments were made to the starting point of a single transaction for related businesses.

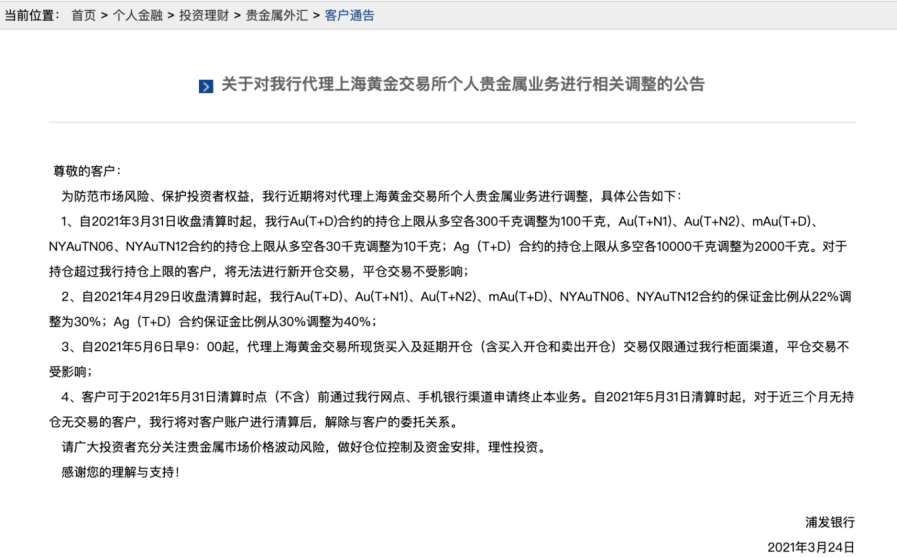

March 30, Shanghai Pudong Development Bank The announcement stated that the account-based precious metal business will be suspended from opening trading on April 6, and the implementation of the stock precious metal fixed investment plan will be suspended. In addition, at the end of this month, the bank will collectively terminate contracts for customers who have no positions in account precious metals business and precious metals fixed investment business. Not long ago, Shanghai Pudong Development Bank also announced that it had adjusted its personal precious metal business as an agent of the Shanghai Gold Exchange, and it had tightened its position limit and contract margin ratio.

March 11, Industrial Bank The announcement also shows that the account precious metals system will stop newly opened positions starting on the 6th of this month; positions that have not been closed after September 30 will be closed by the bank.

In the announcements of the above-mentioned banks, the “prevention of business risks” has been moved to the forefront.

However, some banks stood still. A grassroots person from a major bank in East China told a brokerage China reporter that his grassroots institution has not yet received the notice of adjustment of precious metals-related businesses, but from a risk perspective, it is mainly related to the fluctuation of international gold. The employee bluntly said: “Our grassroots The bank’s business adjustment signs are not obvious, and no specific notice has been received.”

Market risk is in dynamic change, aiming to take precautions

Some senior executives close to major banks revealed to the brokerage China reporter that under the current international market environment, the bank’s initiatives are also actively shrinking in response to regulatory requirements, aiming to take precautions.

“In fact, we just think this thing is too risky and we don’t want customers to do it, but we can’t stop it directly, so we raised the risk level and suggested that they don’t move it.” The person spoke bluntly to reporters.

Why did you choose to tighten adjustments at this time? Many people in the industry said that this is actually the performance of financial institutions to guard against market volatility risks.

Zhou Maohua, an analyst at the Financial Markets Department of Everbright Bank, pointed out to reporters that since April, the overall trend of overseas markets has been “abnormal”, and the recent global epidemic has experienced repeated trends, national policies have diverged, differences in U.S. inflation expectations have been difficult to bridge, and geopolitics have emerged one after another. It indicates that the volatility of precious metals in the external market may increase, and financial institutions will tighten their account precious metal investment business and reduce their exposure to precious metal investment risks.

Some market analysts also told reporters that banks are now following up and making adjustments to avoid risks, mainly out of consideration of risks and responsibilities for hedging. In addition, the epidemic has improved, the U.S. economy has begun to recover, U.S. bond yields have risen, the Fed’s interest rate hike expectations have increased, and the U.S. dollar index has increased, which has caused a certain impact on the price of gold. To prevent it from causing losses in a fluctuating economic environment”.

Specifically, the bank’s move is to implement the appropriate management obligations of financial institutions. “Market risk is undergoing dynamic changes, and the volatility of foreign-market futures businesses is often greater. Financial institutions adjust risk ratings based on actual conditions to ensure that investors’ risk appetite and tolerance are more matched.” Zhou Maohua mentioned that the bank’s move would also help. In order to reduce some potential investment disputes in the future, and maintain its own market reputation.

Zhou Maohua further analyzed that, from some cases, banks may face risks in external disk business in several aspects: first, market risk, market risk of external disk volatility, especially commodity futures business, which is relatively more volatile; second, regulatory and reputation risk , “To attract customers” may also cause some banks to effectively perform investor suitability management obligations, and this may cause investor disputes, resulting in damage to the institutional market reputation; the third is the stability of the information system and the operational risks of traders.

The first anniversary of the negative oil price “black swan” event

Last year, the May contract price of US crude oil futures fell into a “negative value” event, which is also one year old. Judging from the intuition of industry insiders, there have been obvious changes in both the regulatory authorities’ strengthening of the protection of investors’ legal rights and the vigilance of institutions.

“The’Black Swan’ incident is very scary. As a bank, I have never encountered such a situation before.” A senior practitioner from a major industry told reporters frankly that once such a situation is encountered, whether it is personal economic or social impact At the level, banks have to bear a lot of responsibilities, “so be more careful now, and the related risks are tightly guarded.” Zhou Maohua also said that in recent months, banks have successively tightened related external disk businesses, which itself shows that institutions have significantly increased their vigilance against potential risks of similar businesses.

Some analysts said that in the short term, it will be relatively difficult to reopen new accounts for precious metals customers, and some banks will also shrink their personal account transactions.

Both investors and banks have suffered certain losses. “There is still much room for improvement in the experience and ability of Chinese banks to participate in international futures transactions. The professional quality training of relevant personnel and the design of related products by banks are in urgent need of improvement.” A senior bank practitioner told the brokerage China reporter. At the same time, the “oil treasure” incident should also be alert to domestic investor education.

From a literal perspective, “investor education” refers to the dissemination of investment knowledge and experience to individual investors by institutions, departments, etc., but investor education is also a process of investors’ self-learning, exploration, and improvement, as well as the mentality of individual investors. The process of maturing experience and ideas, but the basic requirement of institutions with relevant advantages is to perform investor suitability management obligations. Zhou Maohua predicts that before the precious metals market becomes clear, institutions will continue to be cautious about the business in the short term, and the major banks have a demonstration effect. It is not ruled out that some banks will follow up in the future, but it does not mean that institutions will completely shut down such businesses. business.

“The overall impact on domestic investors is limited. On the one hand, domestic banks have not completely closed such business windows; on the other hand, the domestic futures market has developed very rapidly. The depth is significantly enhanced.” Zhou Maohua said bluntly.

Millions of users are watching

On the cusp of trouble! The video of Tesla’s fire went viral, and the male passenger was unfortunately killed! Police: The cause is still under investigation! Accidents happen frequently, so does BYD have a chance?

what’s the situation? The stock market in this country suddenly plummeted, and the central bank showed an “eagle face”? Canada has taken steps to tighten, and the world is waiting with bated breath for tonight’s big show. Is it really going to change?

See also rumors that detonated the market! The two brokerage companies want to merge? The stock price rose instantly! Founder lost more than 100 people during the year. What happened?

Swipe! 3 billion market value is not accepted?The small market value is being abandoned by funds, the research cost of small-cap stocks is too high, and the fund manager: it is difficult for the black chicken to become a phoenix

What signal? Hundreds of billions of Zhang Kun increased positions against the market in the first quarter! 20 billion of funds are fully supported, continue to sweep into liquor stocks, and increase the allocation of bank stocks by 10 points

Heavy! The China Securities Regulatory Commission has clarified the nature of science and technology innovation, and financial technology and model innovation companies are restricted from listing on the science and technology innovation board!New indicators for the proportion of scientific research personnel, see the latest revision

Brokerage China is a new media under the securities market authoritative media “Securities Times”. Brokerage China has the copyright to the original content published on the platform. Unauthorized reprinting is prohibited, otherwise the corresponding legal responsibility will be pursued.

ID: quanshangcn

Tips: Enter the securities code and abbreviation on the WeChat account page of the brokerage firm to view the stock market and latest announcements; enter the fund code and abbreviation to view the fund’s net value.

You must log in to post a comment.