Even in the downturn of the industry, the management fee income of large alternative investment management companies can basically cover their rigid expenditures, so that the company can maintain a continuous positive cash flow.

Du Lihong, the special author of this journal / article

As the world’s largest alternative investment management company, Blackstone has three main sources of income: management fees, performance compensation, and return on principal investment. Among them, the proportion of management fee income in the total income (management fee income + performance return + net investment income) is relatively stable between 40%-50%. Affected by the epidemic from January to September 2020, performance returns will be reduced to negative Correspondingly, the proportion of management fee income in total revenue has increased significantly to more than 100%; in the past 5 years (2015-2019), Blackstone management fee income accounted for an average of 49% of total revenue.

Compared with management fee income, performance compensation is more sensitive to the fund’s own investment income. Since performance compensation is usually withdrawn when the fund’s return rate exceeds the threshold, even if the fund’s assets are still appreciating during the period, as long as its appreciation is reduced, the performance compensation of its management company may drop sharply, or even When the fund assets depreciate, the manager may face the risk of returning the performance rewards that have been withdrawn before. At this time, the performance rewards will be negative. In 2020, affected by the epidemic, Blackstone’s performance compensation in the first quarter fell to -3.274 billion U.S. dollars; with the rebound of the capital market valuation in the second and third quarters, the company’s performance compensation and principal investment income also rebounded, but the first three quarters The cumulative performance reward is still US$300 million; and during the financial crisis, Blackstone also experienced negative performance rewards (in 2008, Blackstone’s performance reward was -12.5 billion US dollars).

Conversely, when the appreciation of fund assets exceeds the threshold, Blackstone’s performance returns will increase exponentially. It can be seen that the performance returns of alternative investment management companies have high volatility characteristics. On average, in the past 5 years (2015-2019), Blackstone’s performance compensation accounted for an average of 45% of total revenue.

As for the principal investment income, for the alternative investment management company, the principal investment at the business level is mainly composed of two parts: one is the amount of capital contributed by the alternative investment management company as a GP (general partner) in the funds initiated and managed by the alternative investment management company. , This part of the capital contribution will be the same as the capital contribution of other LPs (limited partners), which can share the investment income of the fund in proportion and bear the investment loss of the fund; the second is that alternative investment management companies will incubate new business lines/product lines with their own Funds are used as seed capital investment in some new projects and external acquisitions of new teams. We collectively refer to them as “seed capital” business. In addition to the income contribution of the asset itself, this part of the investment will also increase as the business line/product line matures. It will leverage higher asset management leverage to lay the foundation for future expansion of asset management scale, higher management fees and performance rewards. In fact, for many alternative investment management companies, the management leverage of principal investment is of great significance. Far greater than the significance of its investment income.

Blackstone’s business-level principal investment in 2019 is approximately US$6.8 billion, and the resulting net investment income (realized and unrealized asset appreciation income + net interest income + dividend income) is only 530 million US dollars, which is only equivalent to the current year. 7.6% of the total income; but this part of the principal investment supported the scale of assets under management of US$570 billion, which contributed US$3.484 billion in management fee income and US$3.0 billion in performance returns that year; affected by the epidemic in 2020, investment assets will be slightly Depreciation, the cumulative investment income from January to September fell to -71 million U.S. dollars, but because investment income accounted for a relatively low proportion of the total income, short-term fluctuations had little effect on the company’s overall performance. More importantly, It lies in whether these seed capitals can leverage a higher proportion of the scale of assets under management in the long run. In the past 5 years (2015-2019), Blackstone’s principal investment income accounted for an average of 6% of total income.

In summary, for mature alternative investment management companies, the first two together account for more than 80% of the total income, while the principal investment income usually accounts for less than 20%. Among them, the contribution rate of the performance reward in the boom period can reach more than 50%, but the performance reward in the low period will be greatly reduced or even negative. Therefore, the management fee income maintains the basic operation of the company in the long run, and the performance reward determines the company The short-term performance volatility of the investment; as for the principal investment, the contribution of its investment income is less. The more important significance is to maintain the innovation power of the enterprise in the form of seed capital and promote the continuous growth of the scale of managed assets.

The principal investment of alternative investment management companies will amplify the management leverage, and the management leverage will amplify the risk of volatility while amplifying the return on income. That is, when the appreciation of fund assets slows down, the manager’s performance returns will also be greatly reduced. Even negative; however, because the incentive compensation part of the management team in operating costs will also change with performance fluctuations, the incentive compensation will also be greatly compressed in years when investment performance has fallen sharply, and may even be reduced to a negative value (ie , The part of the salary payable that has been confirmed and yet to be paid to the management team is reversed), so in the long run, the profit margin of alternative investment management companies is relatively stable.

Taking Blackstone as an example, Blackstone’s operating profit margins have always been high, ranging from 30% to 60%. Except for 2008, when performance returns were negative, Blackstone’s operating profit margins in all other years were within 30% to 60%. In the years with good performance, the operating profit margin can rise to more than 50%. In the years with poor performance, the operating profit margin can generally be maintained at more than 30%. In recent years, there has been an upward trend. This is largely due to Due to its ever-expanding scale of managed assets and huge single fund scale, the scale effect has effectively reduced the personnel costs and other operating expenses allocated on the unit’s managed assets.

In contrast, Carlyle’s refined product line has reduced the company’s overall operating profit margin to a certain extent. Unlike the giant funds deployed by Blackstone globally, Carlyle pursues a multi-fund strategy that subdivides product lines by region and industry. Correspondingly, the scale of its single fund is small, but its product lines are numerous and the total number of funds is large. This undoubtedly increases the company’s fund-raising costs and the cost of call payment, distribution, and reporting during the fund operation process, and also weakens the management team. The synergy between the two, its operating profit margin is usually between 20%-40%, which is lower than that of Blackstone. However, as Carlyle gradually withdrew from some under-performing business lines and product lines, and introduced an insurance sustainability platform through mergers and acquisitions, its operating profit margins have increased.

Compared with operating profit margins, for alternative investment management companies, a more meaningful indicator is the ratio of rigid expenditure to management fee income, which shows whether alternative investment management companies can continue to maintain profitability and maintain dividends in the trough. According to historical data, Carlyle’s rigid expenditure ratio has always been the highest among the five companies, with an average of about 80%. Among them, in addition to the cost of product line refinement, the follow-up incentive cost of M&A expansion also accounts for a considerable proportion. .

Compared with Carlyle, Apollo Asset Management’s rigid expenditure ratio has always been lower. The reason is mainly due to the construction of the perpetual capital platform. With the contributions of its insurance platforms Athene and Athora, perpetual capital has already accounted for To 60% of Apollo’s total assets under management, and contributed a relatively stable management fee income to it, saving fund-raising costs, and its large entrusted scale also reduced personnel costs, so that the company’s overall rigid expenditure accounted for a relatively high proportion. Low level.

As for Oaktree Capital, on the one hand, the non-performing asset disposal strategy in the post-financial crisis period has reduced investment opportunities and the pace of fundraising has slowed, resulting in a slowdown in the growth rate of management fee income; on the other hand, in order to maintain its stickiness to investors, the company has since 2011 Since the beginning of the year, the pace of launching new products has been accelerated, which has led to an increase in the proportion of rigid expenditures; as a result, from the listing in 2012 to the end of 2018, the company’s management fee income has basically maintained at the level of 700 million US dollars per year, but the cash remuneration of the business department The increase from US$330 million to US$400 million, and the general management fee from US$110 million to US$160 million, caused the company’s rigid expenditures to rise from 59% in 2012 to 71% in 2018.

In contrast, with the expansion of the scale of its assets under management, the ratio of rigid expenditure to management fee income has dropped from 70% during the financial crisis to about 50%, so that it can maintain positive cash flow and provide investors with relatively stable dividends. income.

In summary, the ratio of rigid expenditure to management fee income of large alternative investment management companies is usually between 50% and 80%. The refinement of product lines and subsequent incentive costs of mergers and acquisitions will increase the proportion of rigid expenditures to a certain extent. , And the growth of the scale of the perpetual capital platform can reduce the proportion of rigid expenditure to a certain extent; in addition, the difference in salary structure will also affect the proportion of rigid expenditure. Some companies have a slight proportion of basic salary in total compensation. High, in order to maintain the stability of employees, and some are based on incentive compensation to enhance the incentive effect; but in general, even in the downturn of the industry, the management fee income of large alternative investment management companies can basically cover their rigid expenditures. As a result, the company maintains a continuous positive cash flow. Correspondingly, even under the impact of the epidemic, several listed alternative investment management companies have maintained relatively stable dividend income.

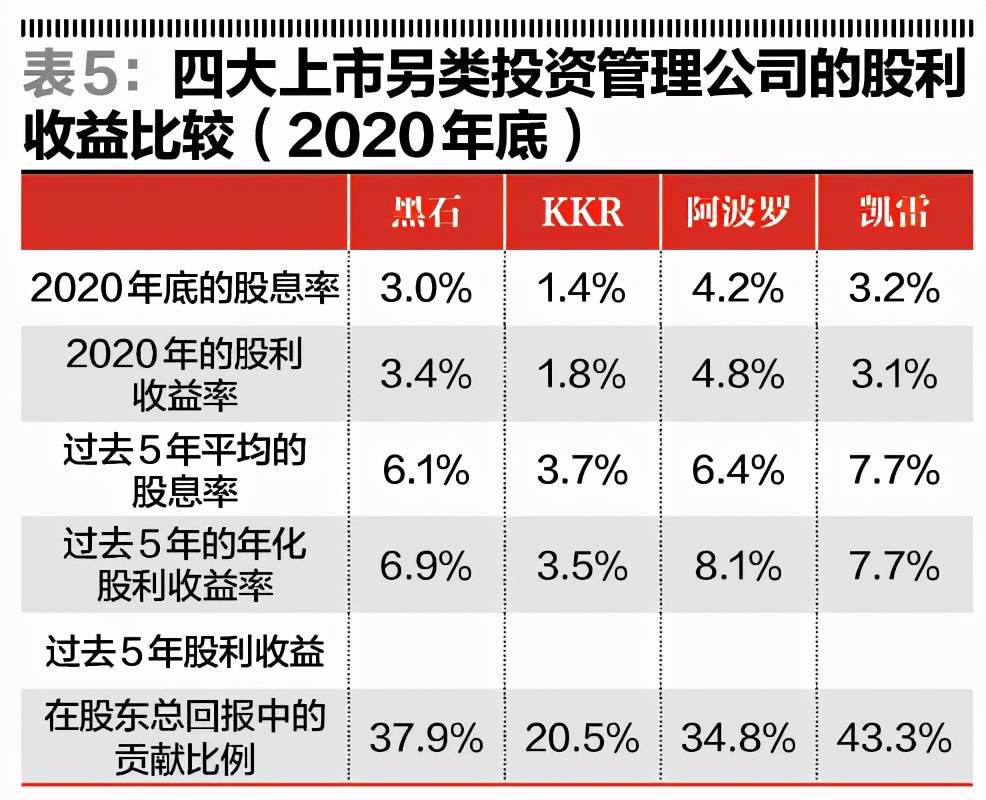

As of the end of 2020, Blackstone’s dividend rate was 3.0%, the average dividend rate for the past 5 years was 6.1%, and the dividend yield rate for the past year was 3.3%; the lowest dividend rate was KKR, which had a dividend rate of only 1.3% as of the end of 2020 , The average dividend rate in the past 5 years is 3.7%, and the dividend yield in the past year is 1.8%; the highest dividend rate is Apollo, which has a dividend rate of 4.8% as of the end of 2020, and the average dividend rate in the past 5 years is 6.4 %, the dividend yield in the past year is 4.8%; while Carlyle’s dividend yield is similar to that of Blackstone. As of the end of 2020, the dividend rate is 3.4%. The average dividend rate in the past five years is 7.7%. The dividend yield in the past year The yield is 3.1%. In short, in the past five years, dividend income has contributed 20%-40% of the total shareholder return of large-scale alternative investment management companies listed in Europe and the United States.

(The author is a partner of Beta Strategy Studio, and the WeChat public account is Du Lihong Alternative Finance.)

You must log in to post a comment.