Recently, medical beauty stocks have become the strongest in the market. Today, when women’s consumption power is getting stronger and stronger, medical beauty has become one of the “good tracks” for long-term sustained high growth.

In the A-share market, there are big bull stocks such as Huaxi Biology, Amec, Huadong Pharmaceutical, and in the Hong Kong stock market, Sihuan Pharmaceutical’s recently represented botulinum toxin product has been approved, and it has also announced that it has entered the track.

Sihuan Pharmaceutical used to be the forefront of domestic generic drugs. However, due to various problems, it has gradually fallen behind. Now, can it be revalued by the style of medical beauty?

1. White poison products bring relatively high growth

First of all, we can see the overall status of Sihuan Pharmaceutical. The company has everything in the pharmaceutical industry. It originally started as a generic drug, but now it has expanded into innovative drugs, CMO, industrial hemp, medical beauty and other fields.

Among them, the layout in the medical beauty industry is the biggest highlight, and it is also the main reason why the company has tripled this year.

Botox is one of the potential markets for domestic medical and aesthetic products. At present, China’s formal Botox market has reached nearly 5 billion, and the growth rate has remained at 20-30% in recent years. The prospects are quite good.

Excluding the formal botulinum toxin market, a considerable part of the botulinum toxin still flows into China through parallel trading channels. Therefore, together with the informal botulinum toxin market, there should be a domestic market space of more than 6 billion yuan.

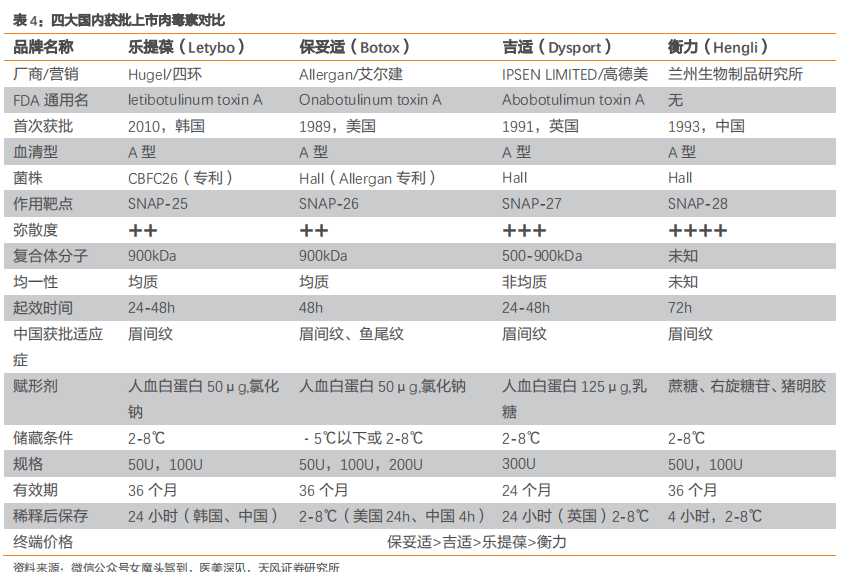

Previously approved botox products in China were mainly Allergan botox and Lanzhou Hengli, each of which accounted for 50% of the market share. In 2020, two new products have been approved, including the botulinum letybo co-operated by Sihuan Pharmaceutical and Hugel, and Gish from the United Kingdom.

From the effect point of view, the product difference is not particularly large. The best and most expensive is of course botox, but low-priced products also have room for cost performance.

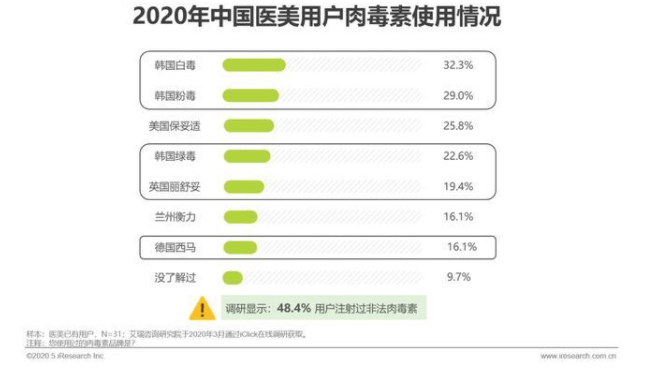

According to some informal investigations, Korean white poison, or letybo, is currently the most widely used parallel product. It has high quality and low price, and has brand protection. It is the product with the highest market share in Korea, a major cosmetic country.

Therefore, Sihuan Pharmaceutical calls out the slogan, and letybo achieves at least double-digit market share within a few years. It is not an emptiness, but has a certain basis. Letybo’s informal market has a considerable scale and has a good awareness. . After the follow-up formal approval, the informal sales of parallel imports will be converted into formal sales, and it will be able to immediately increase the sales to a market of several hundred million yuan. This is also the reason why Sihuan Medicine’s medical aesthetics concept is so popular because of its certainty. Is very high.

However, as far as the botulinum toxin market is concerned, whether the long-term 30% growth will continue, this should be negative.

Because we can see the changes in global sales of botox, it has been declining in recent years. It peaked at around US$3 billion in 2017 and has fallen to around 2.5 billion in 2020.

The botulinum toxin market in the entire United States is about 2 billion to 3 billion US dollars. Therefore, botulinum toxin is not a product with sustainable growth and unlimited ceilings. Taking into account the linear comparison between the US and domestic pharmaceutical markets, the current large pharmaceutical market in the United States is about four times that of China. After China’s economic growth, the Chinese pharmaceutical market can reach the United States in the medium and long term. Half of the pharmaceutical market, so the domestic botulinum toxin market (regular + parallel imports) may be about 1.5 billion US dollars. Even if we optimistically consider letybo’s market share of 20% in the long term, it is about 300 million US dollars, and the sales of 2 billion or so, the profit that can be brought should be about several hundred million.

In the medical aesthetics industry, the logic of Sihuan is still good. The logic of parallel imports ensures that letybo’s sales can increase quickly, and this income volume is comparable to the current income of iMac, but in the long run, a few The profit of 100 million seems to be the ultimate ceiling of this product.

Of course, there will be other products such as hyaluronic acid in the future, but considering that Sihuan’s role is a domestic agent, it cannot be internationalized, nor can it assume the role of a product developer, so in the long run, logic has certain limitations .

2. The outlook for pharmaceutical products remains bleak

The products in the pharmaceutical field have few bright spots. First of all, the company’s revenue of 2.4 billion yuan and 540 million yuan of profit last year have turned losses year-on-year, but we have seen historical data and found that this revenue is the lowest since 2012.

The company’s generic drug business has maintained a steady decline. The approval of its main product cinepazide maleate for new indications for stroke in 2020 seems to bring some new expectations. However, many drugs are still in the monitoring catalog, and the business of supplementary drugs with uncertain efficacy has been eliminated. The long-term high profit margin has been eliminated, and the company’s generic drug research and development has been stagnant for many years. These products are old products for many years. From the side reaction, the company does not have much ability to respond to changes in the industry.

Considering that the company’s current collection of generic drugs with not unique functions, and the revenue of 2.2 billion yuan can still correspond to a profit of about 540 million, the profit margin is still particularly high. Under the tide of centralized procurement, the company’s current products should still have relatively high Under great pressure, in the long run, this business still sees the prospect of gradual decline.

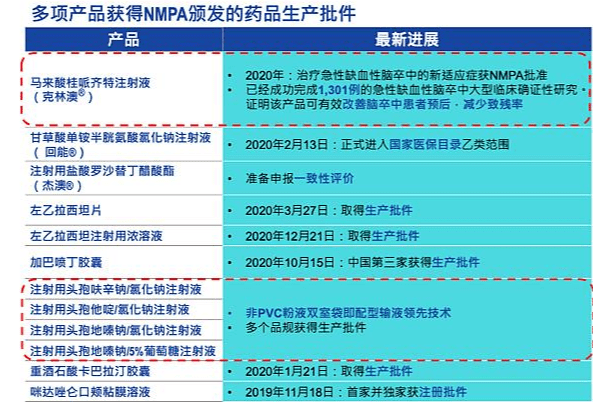

As for the innovative drugs, the company conducts innovative R&D through the acquisition of Xuanzhu Biologics, an innovative drug platform. The current product pipeline is as follows

Source: company information

The current product line is very thin and the market is not large. The leading CDK4/6 inhibitor, the domestic sales of Pfizer’s original research is expected to be about 500 million this year, and Qilu generic drugs are already on the market, and a large number of them are waiting for approval. The company’s products are innovative drugs. If the listing fails to obtain superior results, there is a risk of failure not to be approved, which is not small.

As for the follow-up products, the market space is even smaller, and the target is not new. The company is said to have technical platforms such as ADC and dual-antibody, but those things are too far away. Therefore, the company’s innovative drug business may achieve zero returns.

In addition, the company also has CMO business and industrial hemp business, but there is not much need for analysis.

3. Conclusion

In general, the company’s past was flawed. In the past few years, the suspension of trading due to bribery and the trend of cracking down on supplementary drugs in the pharmaceutical industry made the company unable to cope with the double-kill of a sharp decline in revenue and profit margins. And now, I haven’t seen that this part of the flaw has been clearly corrected.

Of course, Botox cannot deny its prospects. This is also the result of the company’s accumulation in the past few years. Taking into account the popularity of Korean white poison in the domestic informal market, it is inevitable that it will bring a faster increase in the long term. It may also bring in sales of more than 100 million yuan, and you can look forward to several medical beauty products in the future.

However, the pharmaceutical business still accounts for the bulk of the company’s revenue, and the current profit is basically contributed by the pharmaceutical business. The long-term prospects of this business are bleak. Because of the concept of medical beauty to value the pharmaceutical business, it would be a rather blind approach. Relatively speaking, the current market value of more than 20 billion corresponds to a profit of 500 million in the pharmaceutical business. Looking at the next few years, Botox will eventually give a profit of several hundred million. Taken together, the current market value is already in the high range.

In fact, as far as pharmaceutical companies are concerned, cmo can give hundreds of billions of market value to be the industry’s first, double-antibody, and adc can achieve technological leadership and can also give hundreds of billions of market value, and innovative drugs can have breakthrough results. Give hundreds of billions, and the leading generic drugs also have a market value of hundreds of billions, and the market value of Allergan is also hundreds of billions.

But for a company with a revenue of 2 billion, it can do everything if it includes the above-mentioned fields and adds an industrial hemp. Strategically speaking, there is a problem.

The popularity of the medical beauty industry actually has certain psychological factors, because investors can intuitively observe it in life, and labels such as women, consumption, and beauty are easily linked to high profits.

But in fact, seeing its global growth rate and observing the trend of Allergan or Hugel in recent years, it is found that the medical beauty track is also limited. The performance is very general in the entire pharmaceutical industry or the consumer goods industry. Track tuyere can affect short-term trends, but long-term performance is determined. If you don’t believe it, you can look at Marumi and Yixian e-commerce.

You must log in to post a comment.