Author: less words

Source: GPLP Rhino Finance (ID: gplpcn)

On April 19, Changan Automobile (000625.SZ) released its 2020 annual performance report, achieving operating income of 84.566 billion yuan, a year-on-year increase of 19.79%, reaching a historical peak; achieving a net profit of 3.324 billion yuan, a year-on-year turnaround; net profit after deduction The profit still lost 3.25 billion yuan.

And in the first quarter of 2021, Changan Automobile surpassed Geely in sales of its own brand passenger vehicles.

However, behind the dazzling sales volume, Changan Automobile still has performance anxiety.

Behind the merger of “1Malaysia”, the status of joint venture brands is declining

In the history of Changan Automobile’s joint venture, there have been Suzuki, Peugeot Citroen, Mazda, Ford, etc., but Changan Suzuki and Changan Peugeot Citroen have become history, leaving only Changan Mazda and Changan Ford.

According to the production and sales report of Changan Automobile in the first quarter of 2021, the sales of Changan Ford and Changan Mazda were 64,400 and 29,300 respectively. In 2020, the total sales volume of the two joint ventures, Changan Ford and Changan Mazda, was only 500,000, and the total sales volume of the joint venture was one-fourth of the total sales volume of Changan Automobile.

It is understood that in 2016, Changan Automobile’s net profit was 10.3 billion yuan, and Changan Automobile’s net profit from Changan Ford was as high as 9.1 billion yuan, accounting for 88% of Changan Automobile’s net profit. In 2017, the profit ratio was 85%. It can be said that Changan Ford is the main force in the profitability of Changan Automobile.

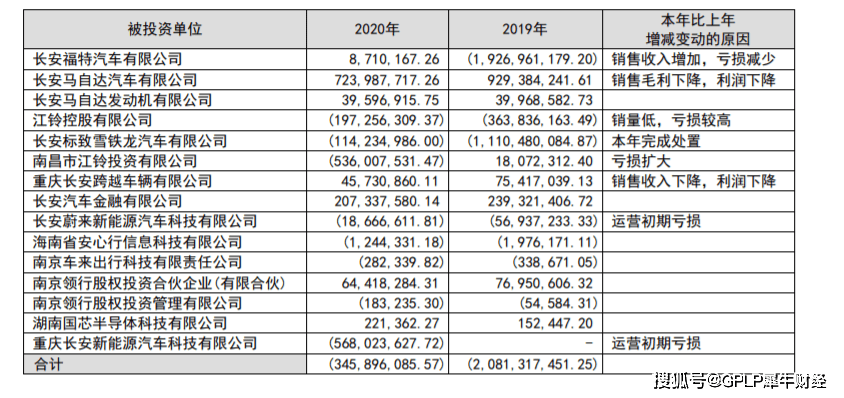

By 2020, Changan Ford’s net profit is only 15.7534 million yuan, and the income has been left behind by Changan’s own brand. Compared with Changan Ford, Changan Mazda is in a better position. Changan Automobile has gained 724 million yuan in revenue, but it is also facing a decline in gross profit and profit.

(Source: Changan Automobile’s 2020 Annual Report)

It is worth noting that there are recent rumors that Changan Mazda and FAW Mazda will merge. Mazda (China) told GPLP Rhino Finance that it has not heard of this news and will not comment on speculative reports by individual media.

However, Changan Automobile is making every effort to promote the development of its own brands, and the importance of joint venture brands to Changan Automobile has declined.

The high-end market has just started, and new energy vehicles are still lacking

It is understood that Changan Automobile now owns Changan Automobile, Auchan Automobile, Kaicheng Automobile and other independent automobile brands, and produces and sells joint venture brand models through joint ventures Changan Ford and Changan Mazda.

The product lineup includes CS series, Yidong series, UNI, Auchan series, Shenqi series, etc.; joint venture brands include Fox, Forex, Sharp, Sharp, explorer, adventurer, Angkerra, CX-5, CX-8, CX-30 and other products.

However, it can be found that without Changan Ford and Changan Mazda, there is no product in the Changan Automobile product camp for the high-end market. Domestic independent brand manufacturers are already deploying in the high-end market. Great Wall Motor has WEY and Geely Automobile has also established Lynk & Co. These two brands have received good market feedback.

In contrast, Changan Automobile launched the new CS75Plus in the fourth quarter of 2019, and since the launch of the UNI-T model in the second quarter of 2020, and in March 2021, Changan Automobile’s high-end mid-size SUV UNI-K was launched, but these products have yet to show signs of going out. . Changan Automobile’s high-end transformation has a long way to go.

In addition, subject to the policies of the new energy industry, the decline of financial subsidies, the new energy double points system (the proportion of new energy vehicles is further expanded, and the new energy points of bicycles are reduced by 20%-40%), and the issuance of domestic industry standards, Changan Automobile needs to increase its R&D investment in battery safety application research, big data monitoring, on-board alarms, and thermal runaway suppression. It is understood that Changan Automobile’s R&D investment in 2020 will be 4.142 billion yuan.

At present, Changan Automobile has built new energy models such as Yidong EV, New Benben EV and CS15EV. However, according to the annual report, Changan Automobile will sell 34,926 new energy passenger vehicles in 2020, and 2,187 new energy commercial vehicles. Its new energy vehicle sales account for less than 4% of its total sales.

However, it is understood that in May 2020, Changan Automobile increased its capital in Changan Weilai New Energy Automobile Technology Co., Ltd. After the capital increase was completed, Changan Weilai New Energy Automobile Technology Co., Ltd. changed from a joint venture to a subsidiary. At the same time, it is reported that Changan Automobile, Huawei and CATL will jointly build high-end electric smart brands and enter the field of new energy vehicles.

At the Shanghai International Auto Show on April 19, Changan Automobile also announced that it will launch 26 new smart electric vehicles in the next five years. The first two smart electric vehicles will be unveiled this year.

However, in the eyes of the outside world, regardless of the high-end brand or the new energy transformation, Changan Automobile is always slower than its peers.

(This article is for reference only, does not constitute investment advice, and operates at your own risk accordingly)

You must log in to post a comment.